4 Powerful Allbound Playbooks for Pipeline Generation 2025

The Ultimate Allbound Guide (for Beginners)

Hey - it’s Alex - this time together with Florian Lussi!

Today we cover:

1️⃣ The 3 Allbound Fundamentals

2️⃣ The 5 Allbound Engine Components, incl. signal capturing and tech stack

3️⃣ 4 Powerful Allbound Playbooks (step-by-step)

Bonus: List of my vetted Go-to software tools for early-stage SaaS startups

In case you missed the last 3 episodes:

✅ The Ultimate Guide on Case Studies & Testimonials

✅ The LinkedIn Sales Navigator Guide

A quick word from our sponsors

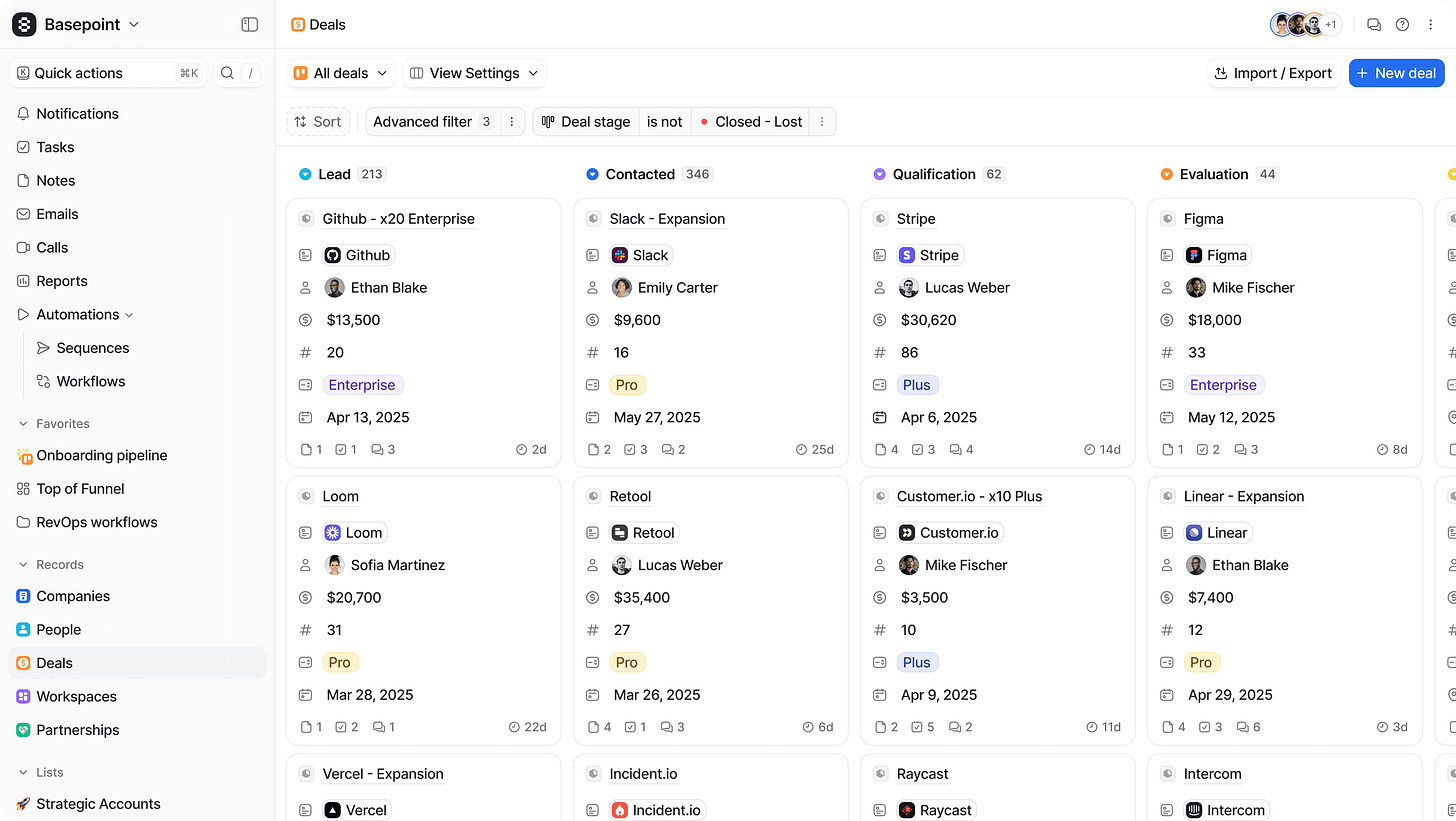

📢 Attio— The AI-native CRM that’s built for the future

Attio is the CRM for the AI era. Connect your email, and Attio instantly builds your CRM - with every company, every contact, and every interaction you’ve ever had, enriched and organized. Join industry leaders like Flatfile, Replicate, Modal and more.

📢 Anima— Europe's fastest-growing healthtech company is HIRING (Job Alert)

Anima is Europe's fastest-growing healthtech company, pioneering agentic AI in precision medicine. We experienced 450% growth scaling from $150k to $7m ARR, and we’re cashflow positive.

Anima is looking for exceptional founders, sales leads, and engineers to join the mission. Remote-first (EU/NA). Fill out the form to speak to the founder, Shun.

Want to reach 4500+ early-stage SaaS founders/leaders? Sponsor the next newsletter.

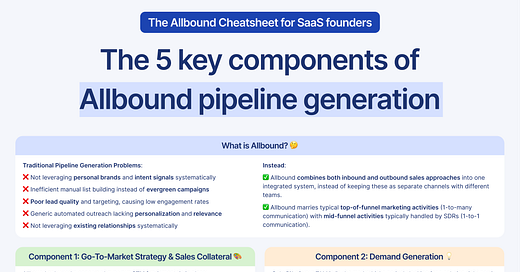

What is Allbound & what are the problems of traditional Pipeline Generation?

Before we deep-dive, let’s quickly talk about what Allbound is & why it’s important, so we all have a common understanding.

Traditional pipeline generation, as companies have been doing for years, has been changing, and two things are fueling this:

✅ Trust has become important for buyers when making a purchase decision. Being a trusted expert in your field is a must-have.

✅ You must have heard this one quite a bit, but “spray and pray” does not work anymore. You need to change your approach to outbound to make it more relevant & personal than ever.

So, B2B SaaS companies face the following challenges with traditional Pipeline Generation tactics:

❌ Not leveraging personal brands and intent signals systematically

❌ Inefficient manual list building instead of evergreen campaigns

❌ Poor lead quality and targeting, causing low engagement rates

❌ Generic automated outreach lacking personalization & relevance

❌ Not leveraging existing relationships systematically

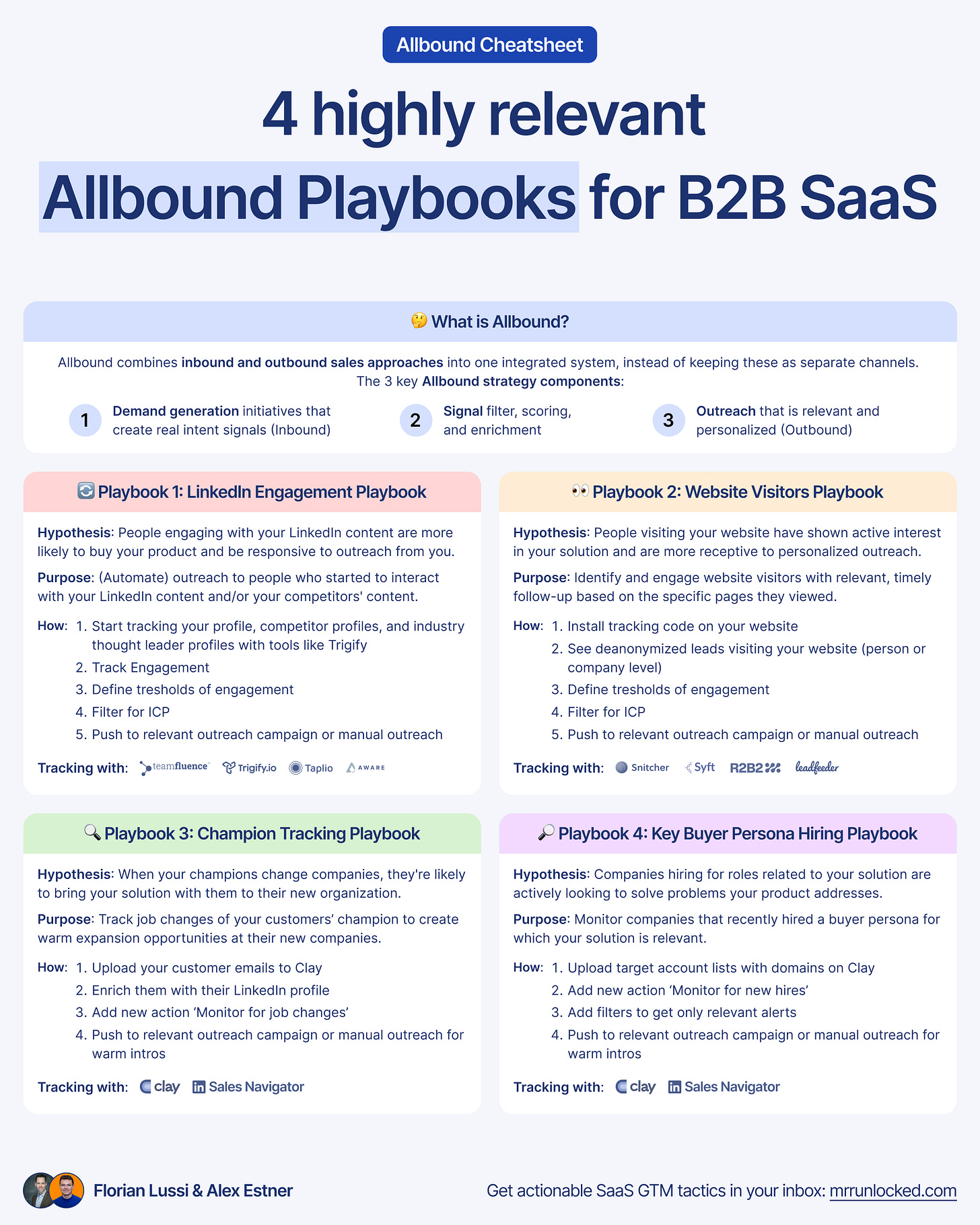

What is Allbound?

‘Allbound’ is an approach that tries to combine ‘Inbound’ and ‘Outbound’ into one integrated approach to fix these challenges.

Allbound combines both inbound and outbound sales approaches into one integrated system, instead of keeping these as separate channels with different teams. (marketing versus sales) fighting for attribution.

Allbound marries typical top-of-funnel marketing activities (1-to-many communication) with mid-funnel activities typically handled by SDRs (1-to-1 communication).

Allbound is leveraging AI and automation, ensuring SDRs can focus on the RIGHT leads while automating the bulk of their manual workload.

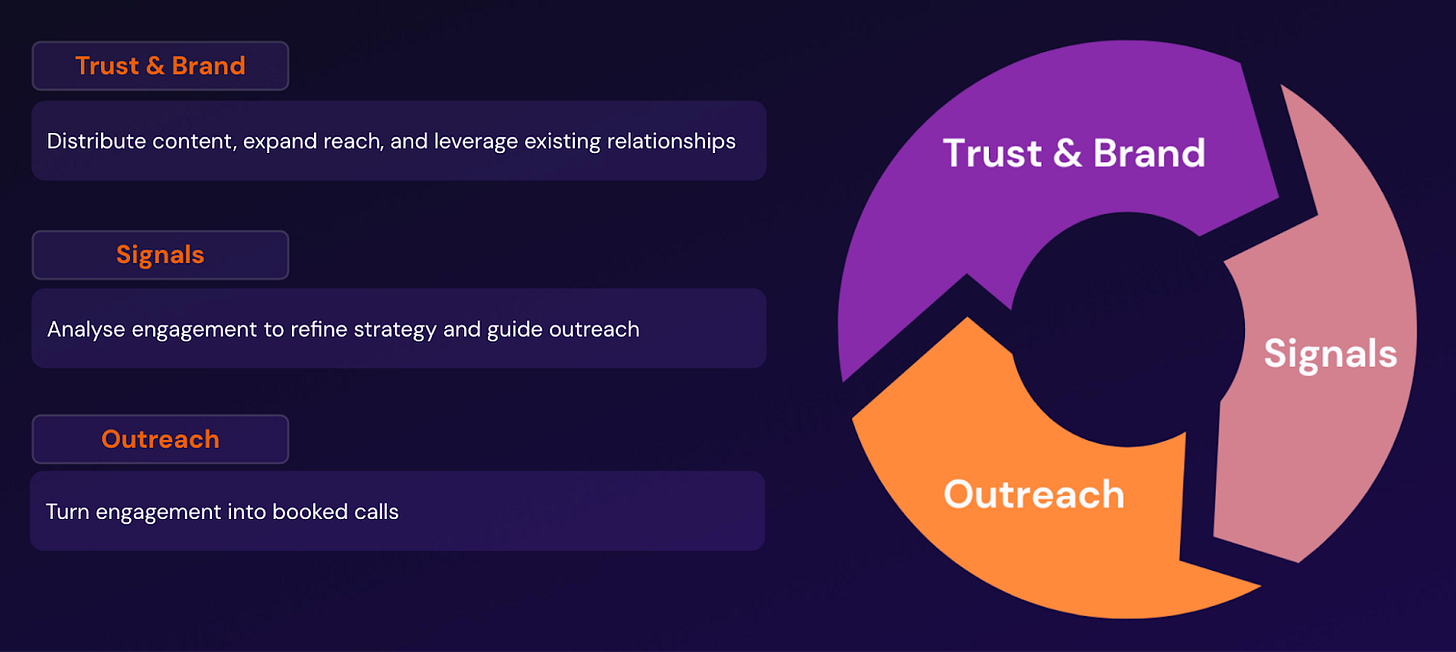

The three key components of a solid Allbound strategy are:

1️⃣ Demand generation initiatives that create real intent signals (inbound)

2️⃣ Signal filter, scoring, and enrichment engine.

3️⃣ Relevant & personalized outreach (outbound)

To make this easy to understand, here is a simple example:

The founder is posting on LinkedIn

Person from target audience engages with the post (= low intent signal) and visits multiple website pages afterwards (= mid intent signal)

These signals are tracked, and the founder is reaching out to this person with a personalized and relevant LinkedIn message based on the viewed website pages.

The 3 Allbound Fundamentals

Allbound pipeline generation must always be tailored to your specific GTM motion.

If you get this wrong, you can quickly burn through your Total Addressable Market and close doors instead of opening them.

So let’s have a look at 3 Allbound fundamentals.

1. Align your GTM approach with your ICP’s Business Segment

When you read B2B pipeline advice on LinkedIn, you'll find polar-opposed opinions:

"Just closed 200k through my network. Shocking that human connections still work in 2025!"

vs.

"My AI outbound system built 450k in pipeline on autopilot. Networks are overrated."

The missing piece? GTM context.

Both approaches can work, but for entirely different GTM motions.

Different target customers and different ACVs require different engines (aka. GTM tactics).

The size of your deals (ACV) dictates how you approach your market.

For small deals, you cannot afford to run a high-touch motion, whereas for large deals, you often can and have to run a high-touch motion.

This is very important when you fine-tune and customize your allbound engine.

For example:

In a low-touch allbound engine: Website visitors are automatically approached with an automated email (after the AI qualifies them), whereas

In a high-touch allbound engine: Website visitors are qualified by the AI, but typically only a task is created (supplemented with account research by AI agent) for the Account Executive to follow up and reach out very individually.

Similarly, if you create a lead magnet for your GTM motion, this is maybe an ebook for a medium touch motion, but rather a very high-end, exclusive round table with relevant executives for high touch motion (e.g. CTO in B2B SaaS with engineering teams of +20 people in Germany).

Always look at pipeline generation advice through your very specific GTM-lens!

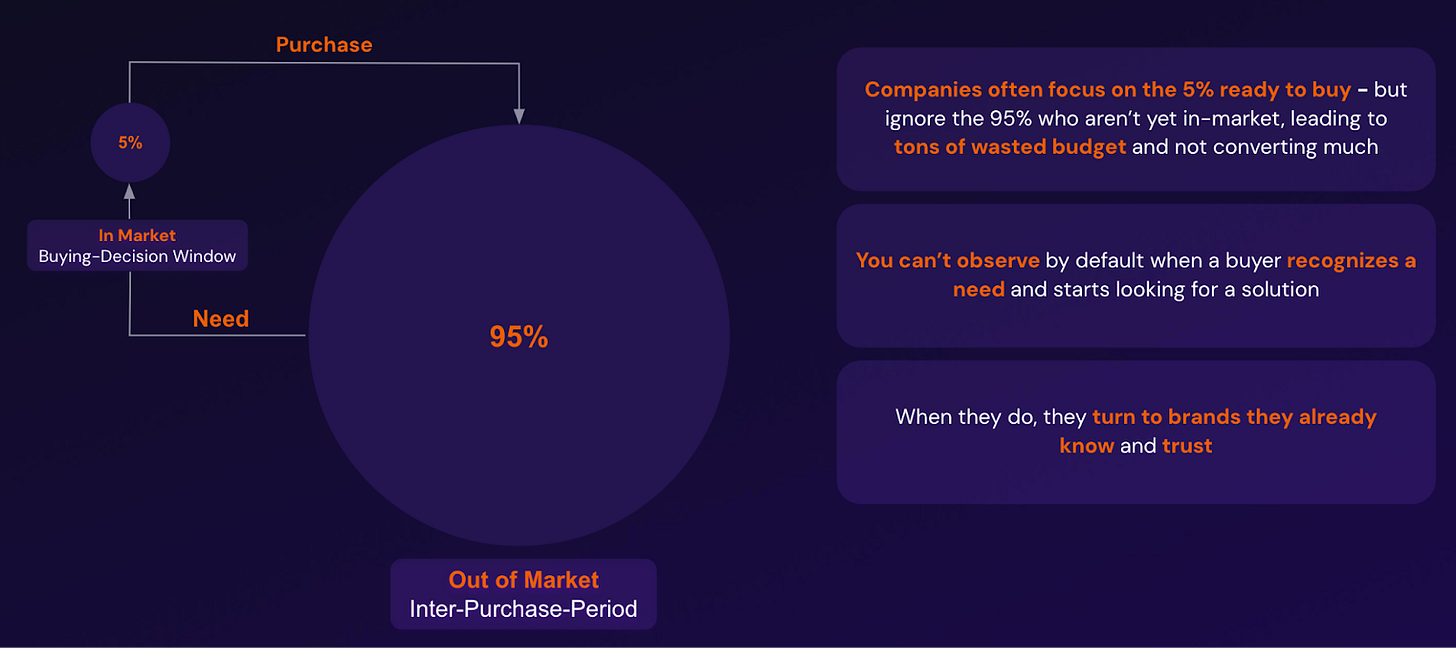

2. The 95-5 rule: In-Market vs.Out-Market Truth

A second very important fundamental is that only a fraction of your Total Addressable Market (TAM) is “in-market” (aka. actively looking for a solution right now) today.

Picture a city of 100 potential prospects. On any given day, 95 of them are not ready to buy because:

"Our current setup works fine"

"Never heard of this solution"

"Just signed with someone else"

"Don't see this as a priority"

The 5% buying today remember the brands they noticed BEFORE they were in-market -Brand Awareness!

Why is this important?

You want to stay top of mind with the 95% out-of-market buyer and leverage (intent) signals to know when they go from “out of market” to “in market”.

So (intent) signals are the best proxies to know when your target audience is ready to buy.

Yes, the reality is a bit more complex. The gist remains the same: keep top of mind for the 95% that are not buying today and understand when they start actively researching solutions.

3. Allbound requires a new skillset (GTM Engineers & modern SDRs)

The traditional SDR model: cold calling, emailing, list-building, and qualifying prospects, is outdated and leads to several inefficiencies:

Time waste: Up to 70% of an SDR’s time goes to non-revenue tasks like manual research and admin work.

Scalability issues: Scaling pipeline requires a direct increase in SDR headcount, making growth costly and unpredictable.

Qualification challenges: Without proper signals, SDRs often chase unqualified prospects, reducing efficiency.

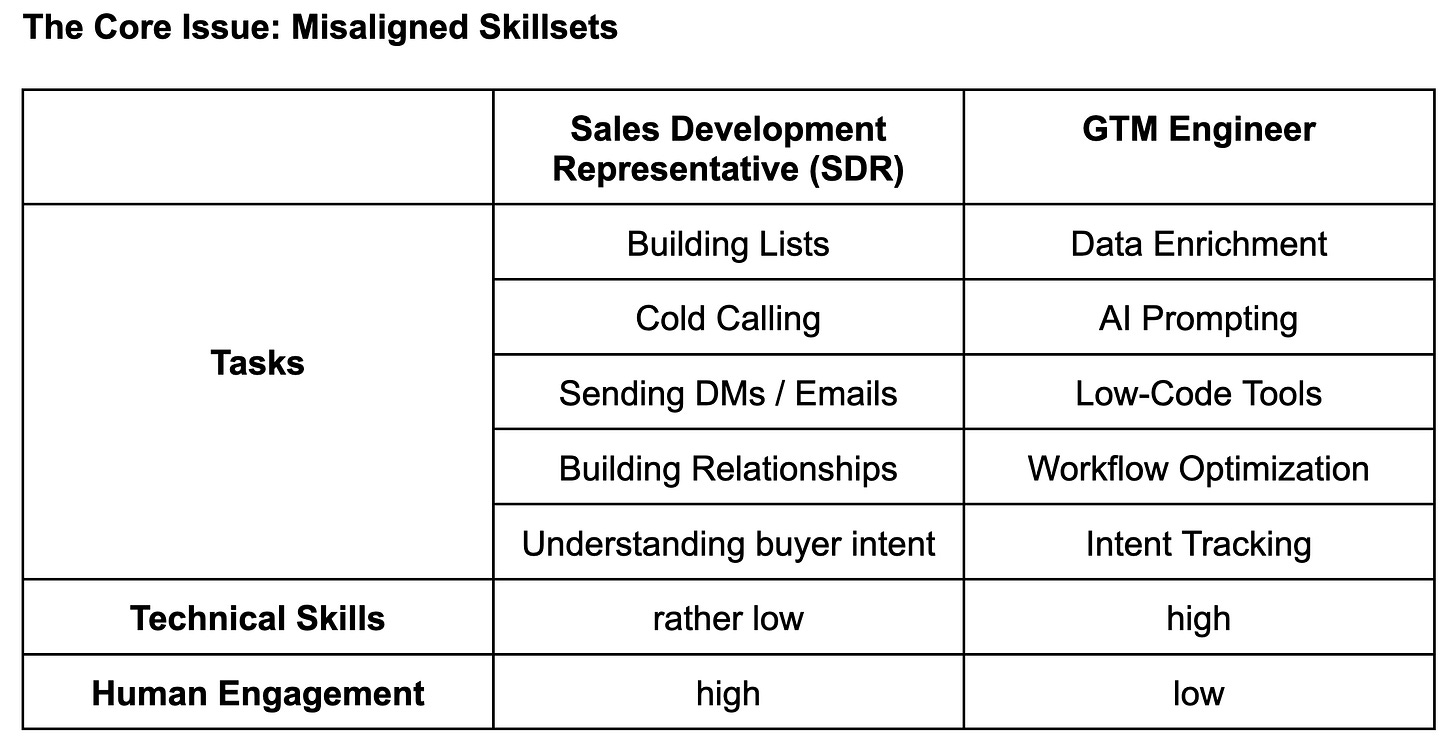

The Core Issue: Misaligned Skillsets

Learn more about the role of the GTM engineer in the guide published by Matteo.

The SDRs perform two fundamentally different jobs requiring distinct expertise:

Technical/automation tasks: Managing the latest tools, data enrichment, and workflow optimization.

Human engagement: Building relationships, understanding buying intent, and strategic outreach.

Instead of relying on traditional SDRs, a hybrid approach improves efficiency:

GTM Engineers handle automation, optimize prospecting workflows, and integrate AI-driven signals.

SDRs shift focus to high-value conversations, engaging only when intent is clear.

Results:

SDR time spent on actual prospect conversations.

Scalable growth without direct headcount expansion.

Higher conversion rates by engaging based on buying signals.

By modernizing the SDR function, you can reduce headcount while increasing pipeline efficiency, which directly improves CAC.

Now, let's jump into the 5 components of an Allbound Engine and look at some practical examples.

👇This guide might be too long for your email inbox. So read the full guide here 👇

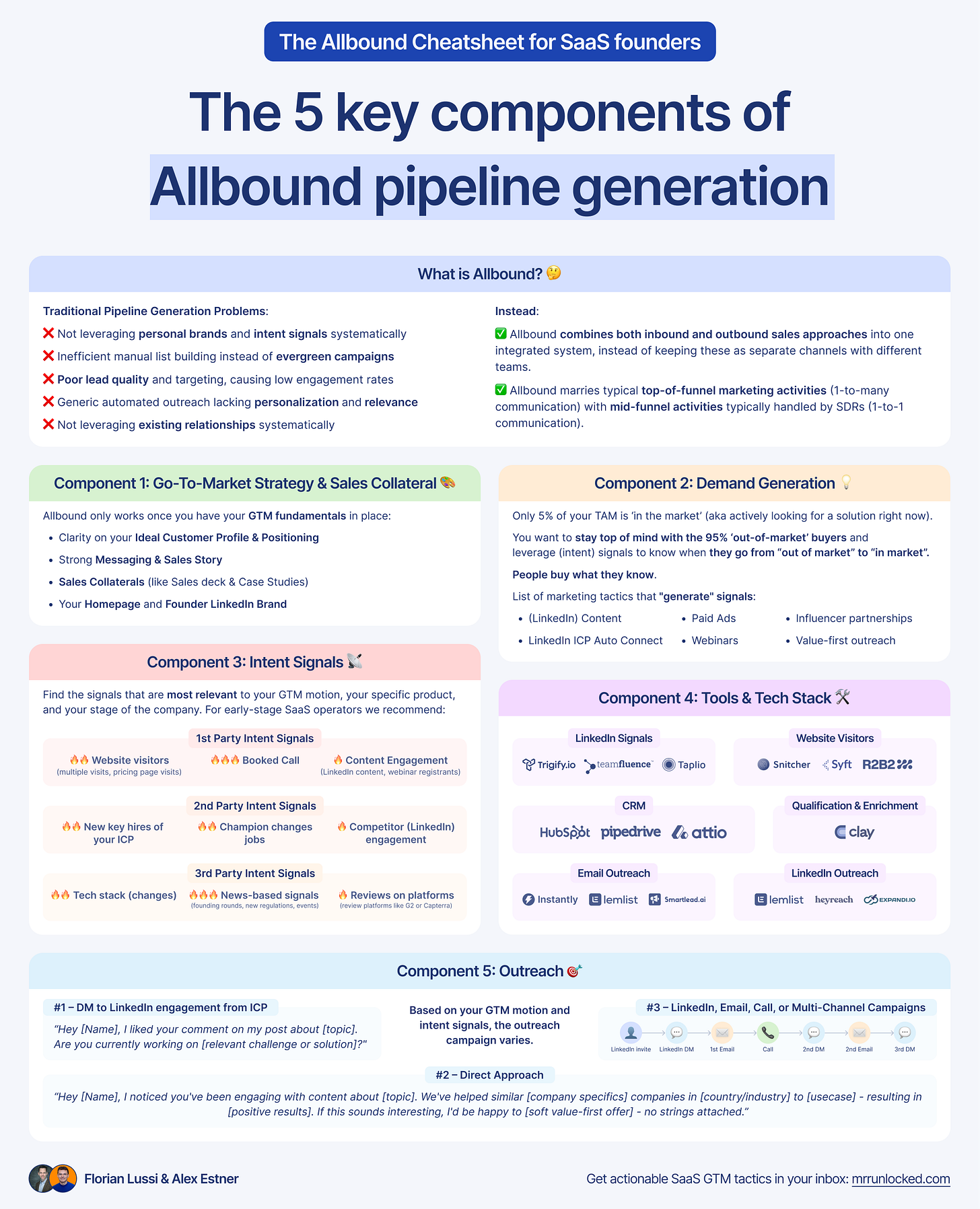

The 5 Allbound Engine Components

Allbound pipeline generation has 5 key components.

Go-To-Market Strategy & Sales Collateral: The foundation of your pipeline generation efforts, ensuring your messaging resonates with your ICP.

Demand Generation: Creating awareness and interest in your solution through various channels like content, paid ads.

Intent Signals & AI Automation: Identifying and acting on prospect signals that indicate buying intent through systematic processes.

Tools & Playbooks: Knowing the right tools and how to integrate them properly for the different allbound playbooks.

Outreach: The tactical execution of personalized communication based on intent signals.

In this guide, we will mostly focus on intent signals & AI Automation, and the tools & playbooks building on that component.

The other components have been covered well by previous newsletter episodes and SalesPlaybook, and we will link to relevant resources.

Component 1: Go-To-Market Strategy & Sales Collateral

The key factor that we’d like to stress again is that having your Go-To-Market strategy & sales collateral in place is imperative to make the most of your allbound strategy.

It is beyond the scope of this article, but luckily, some previous mrrunlocked guides can help you with this:

Clarity on your Ideal Customer Profile

Strong Sales Story & Messaging

Sales Collaterals (like sales deck, Case Studies, or SaaS Homepage)

Component 2: Demand Generation

People buy what they know.

Two key stats to help you understand the importance of this component:

80-90% of buyers have a predefined set of vendors in mind before researching. This is what we call a ‘consideration set’ that buyers create before starting their search.

90% ultimately chose from this initial list.

Consider your purchasing behavior - you rarely buy from unknown brands without research, and B2B customers follow the same pattern.

This is why direct outreach alone rarely generates meaningful conversions. This is where demand generation comes in.

You need to execute marketing tactics that "generate" signals (aka. demand generation) to make sure you get on the ‘initial list’ of your buyers (be on the ‘consideration set’).

Here’s a list of key demand generation activities to get on the ‘consideration set’:

LinkedIn ICP Expansion: Send 20-30 connection requests daily to your target buyer persona. No selling, just connect, say hello, and build visibility (LinkedIn auto-connect campaigns)

LinkedIn Content: Publish 2-3 high-value posts per week to “warm-up” your network/market. Create a strong content strategy to make sure you attract the right audience.

Paid Search Ads: Create paid ads focused on building brand awareness and nurturing future buyers who aren’t yet looking for a solution.

Paid Social (LinkedIn Ads): Turn valuable organic content into thought leadership LinkedIn ads

Webinars: Run monthly webinars or quarterly summits with relevant topics that extend your company’s network reach.

Influencer partnerships & Sponsorships: Get your brand in front of your ICP by sponsoring events, newsletters, or paying influencers for brand partnerships.

Value first Outreach: Cold outreach for demand generation means reaching out to people who haven’t heard of you yet with educational or problem-focused resources, not pushing them to book a call, so they’ll remember you when they’re ready to buy. Use value-first LK campaigns, cold outbound guide, and high-value offer-based campaigns to learn more about it.

Once you have your demand generation motion in place, you need to know how to leverage the signals generated through demand generation.

Component 3: Intent Signals

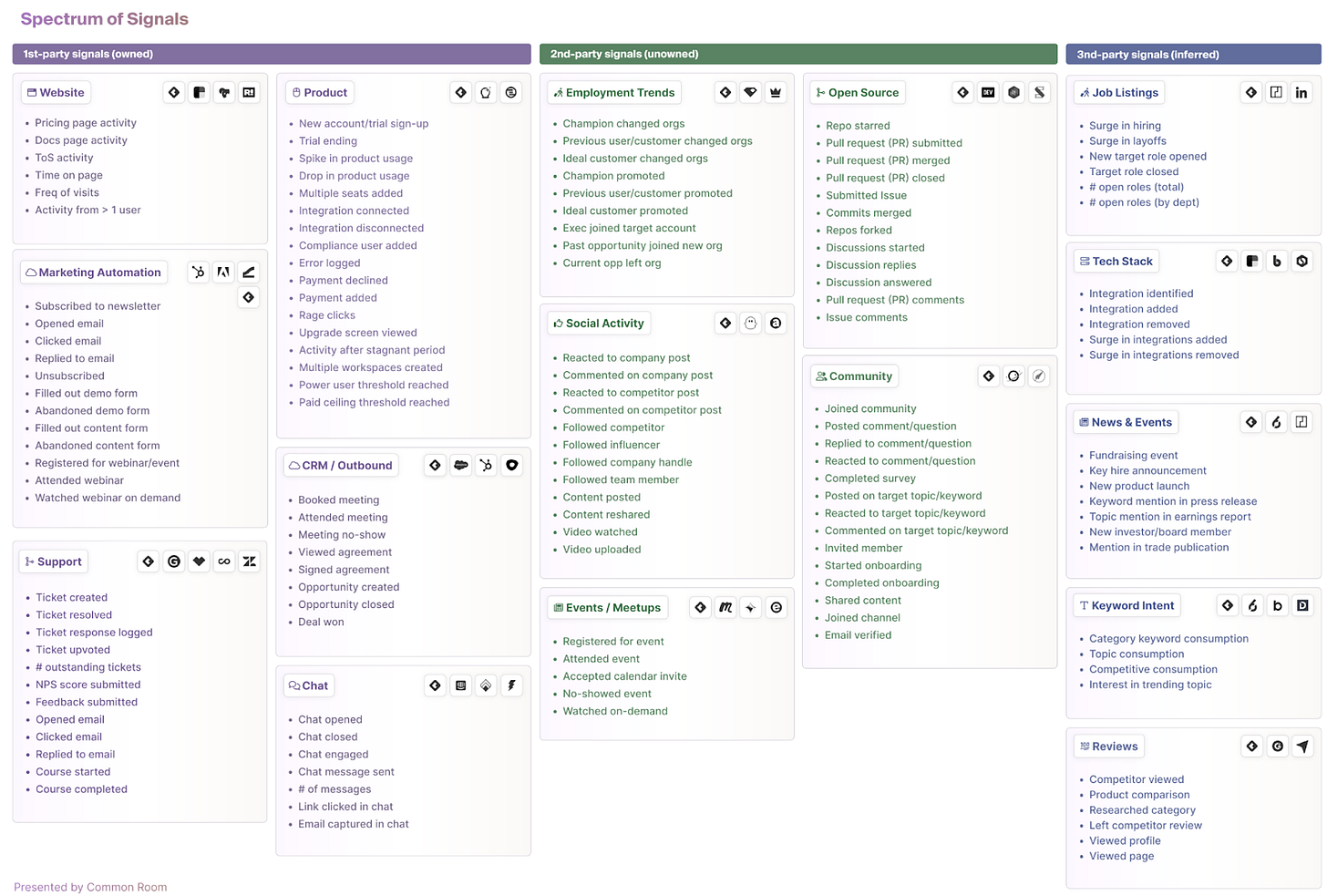

The spectrum of signals is huge.

The comprehensive overview below gives you a better understanding of what's possible, but you can also get easily lost.

To avoid this, you must find the signals that are most relevant to your GTM motion, your specific product, and your stage of the company.

Not all signals are equal. They range from meaningless noise to highly actionable data.

Let’s have a look at some highly relevant signals for early-stage SaaS operators.

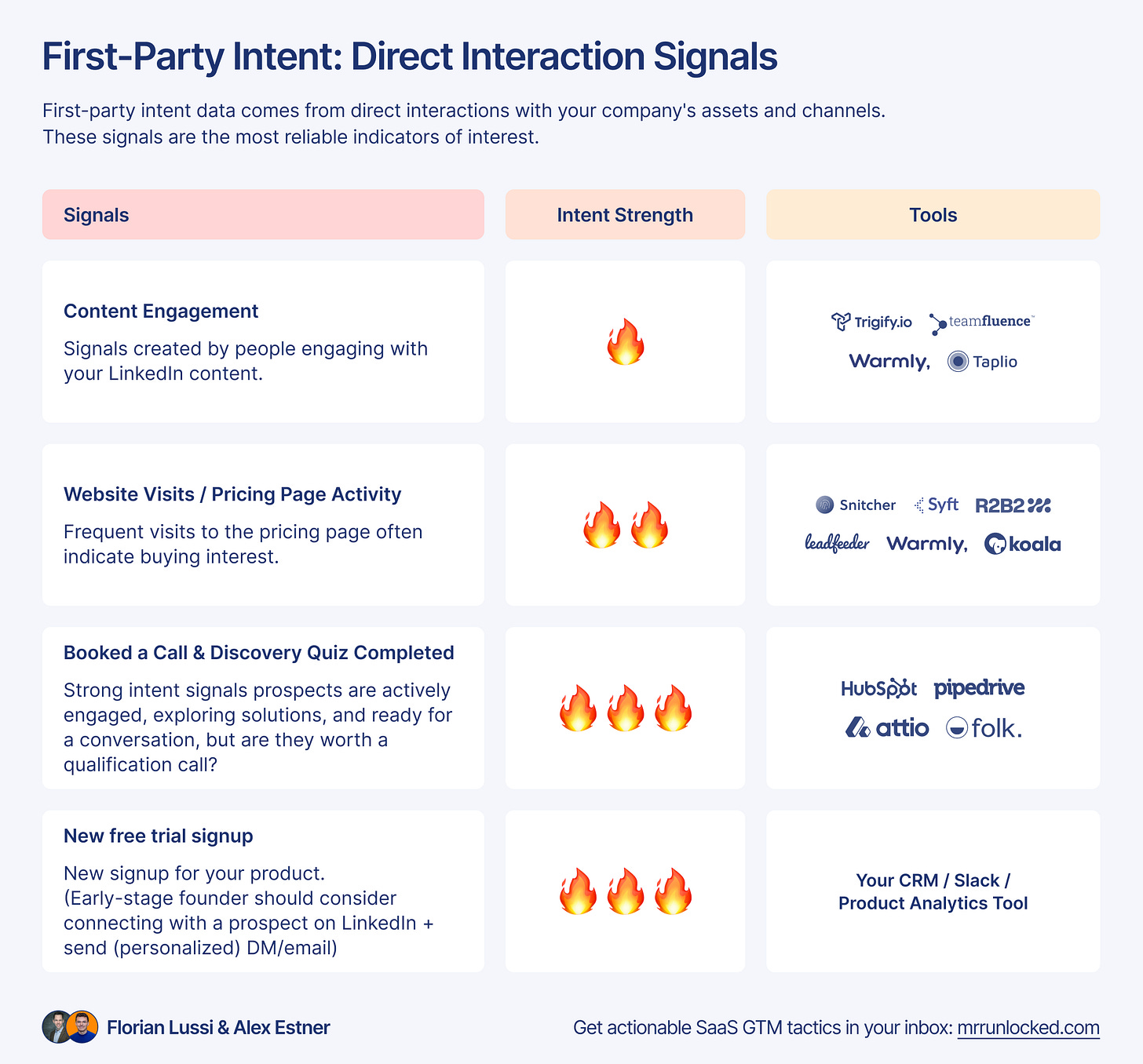

First-Party Intent: Direct Interaction Signals

First-party intent data comes from direct interactions with your company's assets and channels. These signals are the most reliable indicators of interest.

Content engagement

Signals created by people engaging with your LinkedIn content.

Intent Strength: 🔥

Tools: Trigify, Teamfluence, Warmly, (Taplio), Reactin

Pricing Page Activity

Frequent visits to the pricing page often indicate buying interest.

Booked a Call & Discovery Quiz Completed

Strong intent signals prospects are actively engaged, exploring solutions, and ready for a conversation, but are they worth a qualification call?

New free trial signup

New signup for your product.

Intent Strength: 🔥🔥🔥

Tools: Your CRM/Slack/Product Analytics Tool

Being early-stage? The founder should consider connecting with a prospect on LinkedIn + send (personalized) DM/email. We talked about this on the Founder LinkedIn Guide.

Second-Party Intent: Partner Network Intelligence

Second-party data comes from trusted partners and tools.

LinkedIn, the world's largest professional network with more than 1 billion members, is the primary source for most of this data, including the signals we'll discuss below.

However, we need specialized tools to extract data from LinkedIn so we can automate workflows. While a LinkedIn Sales Navigator license is powerful, it doesn't support many of the automations we'll cover.

Signals:

Monitor Job Changes

Understand when a champion changes their company or department.

Intent Strength: 🔥🔥

Tools: Clay, LinkedIn Sales Navigator

Monitor Promotion

Understand when a champion is promoted.

Intent Strength: 🔥🔥

Tools: Clay, LinkedIn Sales Navigator

New Hires

Monitor new hires of your ICP.

Intent Strength: 🔥🔥

Tools: Clay, LinkedIn Sales Navigator

Competitor Engagement

Target LinkedIn profiles that engage with your competitors on LinkedIn.

Intent Strength: 🔥

Tools: Trigify

Industry Thought Leader Audience

Target the audience of influential voices in your space.

Intent Strength: 🔥

Tools: Trigify

Third-Party Intent: Market-Wide Signals

Market-wide signals that often allow us to infer intent or qualify prospects.

Signals

Technology Stack (Change)

Reveal technical environments. Often used for enrichment & segmenting. But you can also infer intent.

Intent Strength: 🔥🔥

Tools: Builtwith, predictleads, (LinkedIn Sales Navigator)

Review Websites

Use customer reviews on platforms like G2 or Trustpilot to quickly identify common complaints, issues, and bugs in a prospect's product. Or use Negative reviews of your competitors' products as a relevant signal for your outreach.

Intent Strength: 🔥

Tools: Capterra, G2, Trustpilot

News-Based Signals

Compliance Updates: New regulations can drive demand for solutions that ensure compliance.

Funding Rounds: A business receiving new investments often has budget flexibility and growth initiatives that require external solutions. Tip: The optimal moment for outreach isn't always immediately after a funding round, but you can infer when the next round should take place.

Market Expansion: Firms entering new markets or geographies often face new challenges and seek relevant solutions.

Intent Strength: 🔥🔥🔥

Tools: News, RSS Feeds, Crunchbase, Google Alerts

Tech Stack Overview

Usecase: LinkedIn Signals

Trigify: monitors LinkedIn to identify prospects engaging with specific topics, your LinkedIn posts, or your competition's LinkedIn posts. Important: Trigify does not monitor LinkedIn profile views; for this, we recommend teamfluence.

Alternatives: Warmly, (Taplio), Reactin

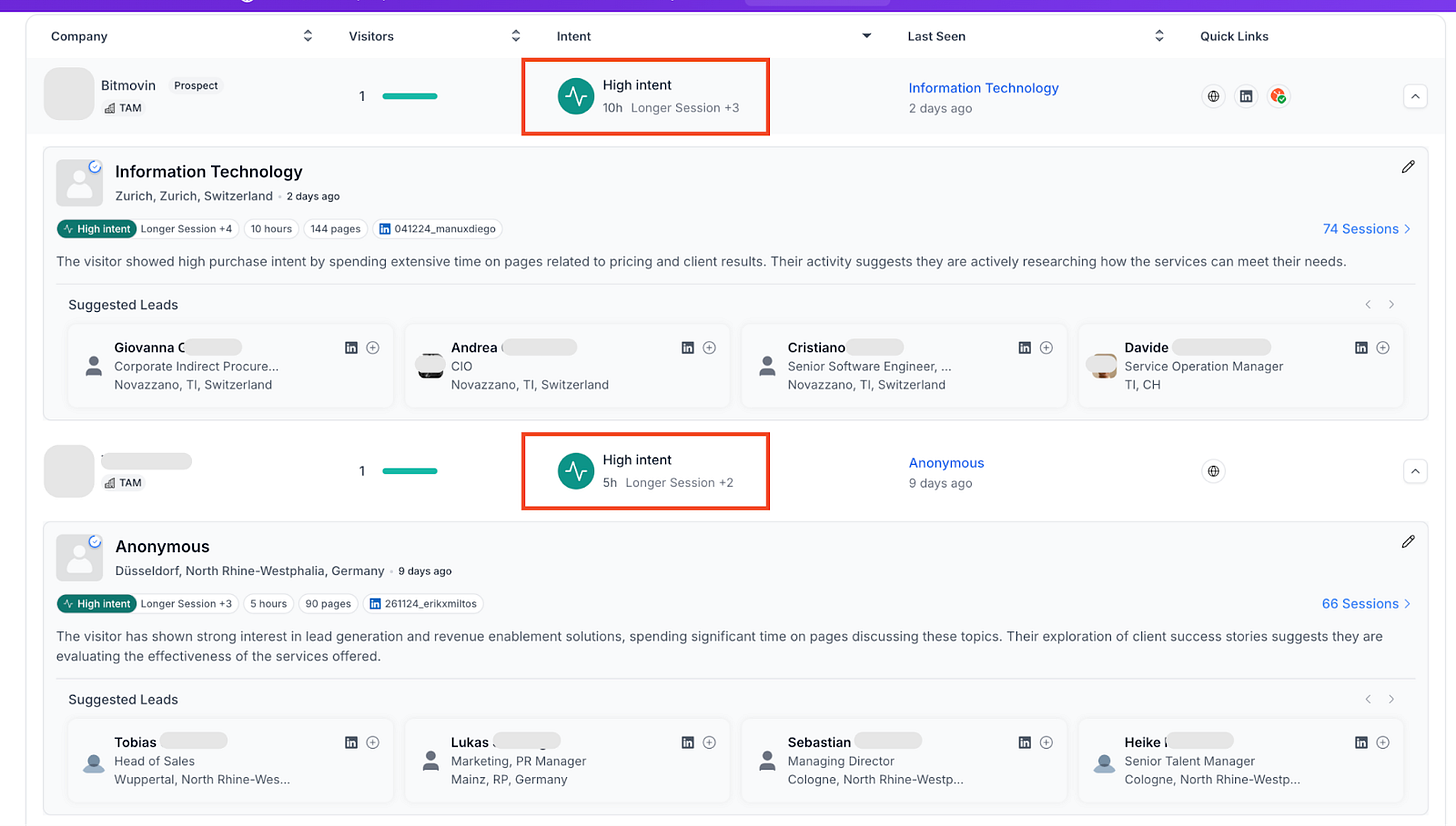

Usecase: Website Visitors

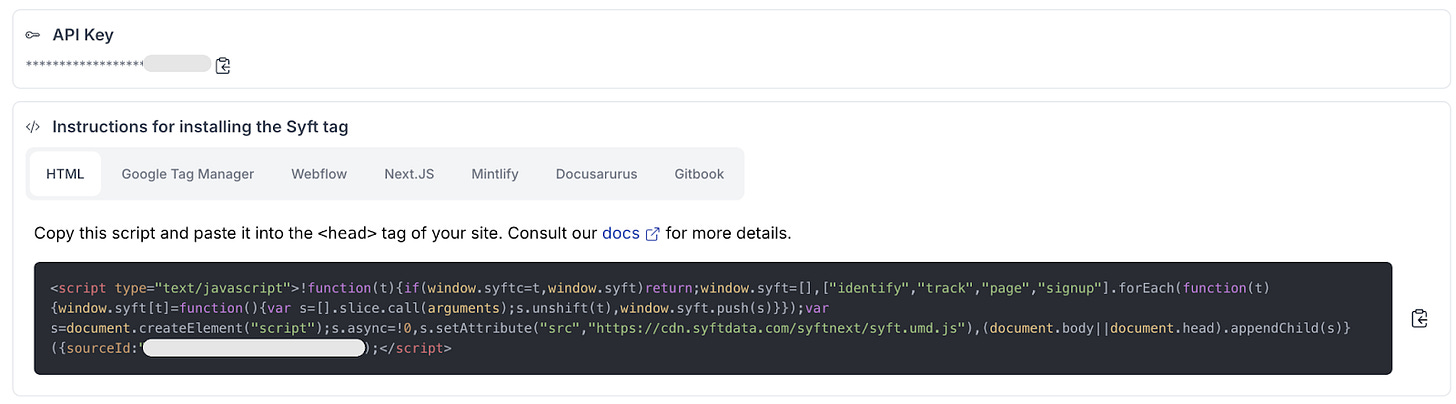

syftdata.com: Identifies and deononymizes website visitors.

Similar tools: Snitcher, syftdata, leadfeeder, RB2B, Warmly, Koala

Usecase: AI Processing, Qualification, Contact Data Enrichment

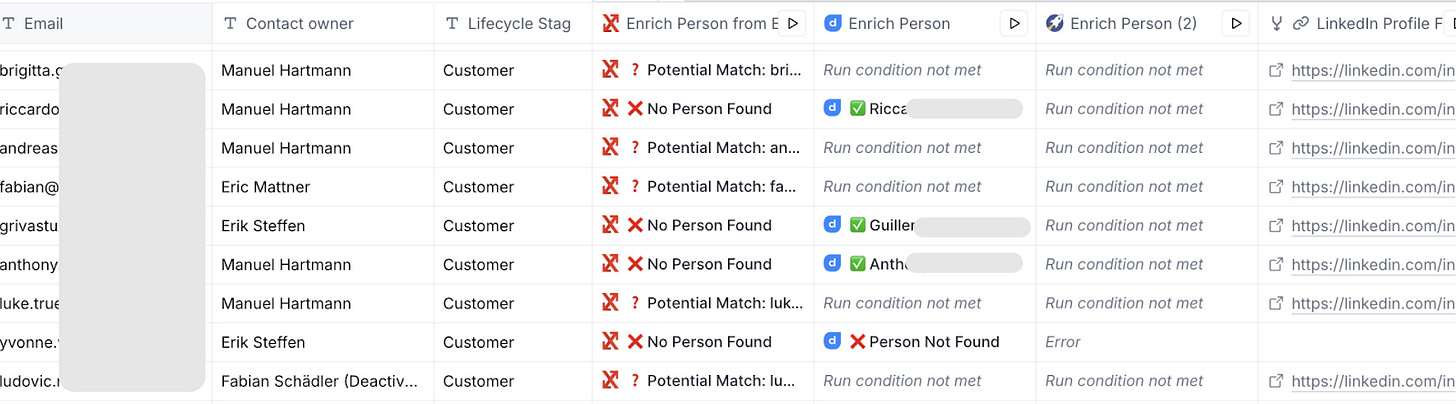

clay.com: is the brain of our allbound engines.

It checks, qualifies, and scores leads. It also enriches contact data (waterfall from multiple data sources) and leverages AI to personalize messages.

Finally, you can automatically send a lead into an email or LinkedIn campaign if “running conditions” are met.

Extra tip: In order not to burn through too many expensive clay credits, you can integrate your open.ai subscription and data provider subscriptions with clay.

Usecase: CRM

Hubspot is a CRM platform that integrates seamlessly with many leading go-to-market (GTM) tools such as clay.

Alternatives: Pipedrive, Folk, Attio

Usecase: Email Outreach

smartlead, instantly, Lemlist all offer cold outreach sequencing and warmup.

Instantly & smartlead are great for large email volume, Lemlist for smaller volume and multi-channel sequencing (email & LinkedIn).

Usecase: LinkedIn Outreach

heyreach: Automates LinkedIn outreach, allowing multiple senders to reach numerous leads weekly, with a unified inbox for managing replies. Lemlist is another great option. Expandi is another tool; however, integration into clay is not native yet.

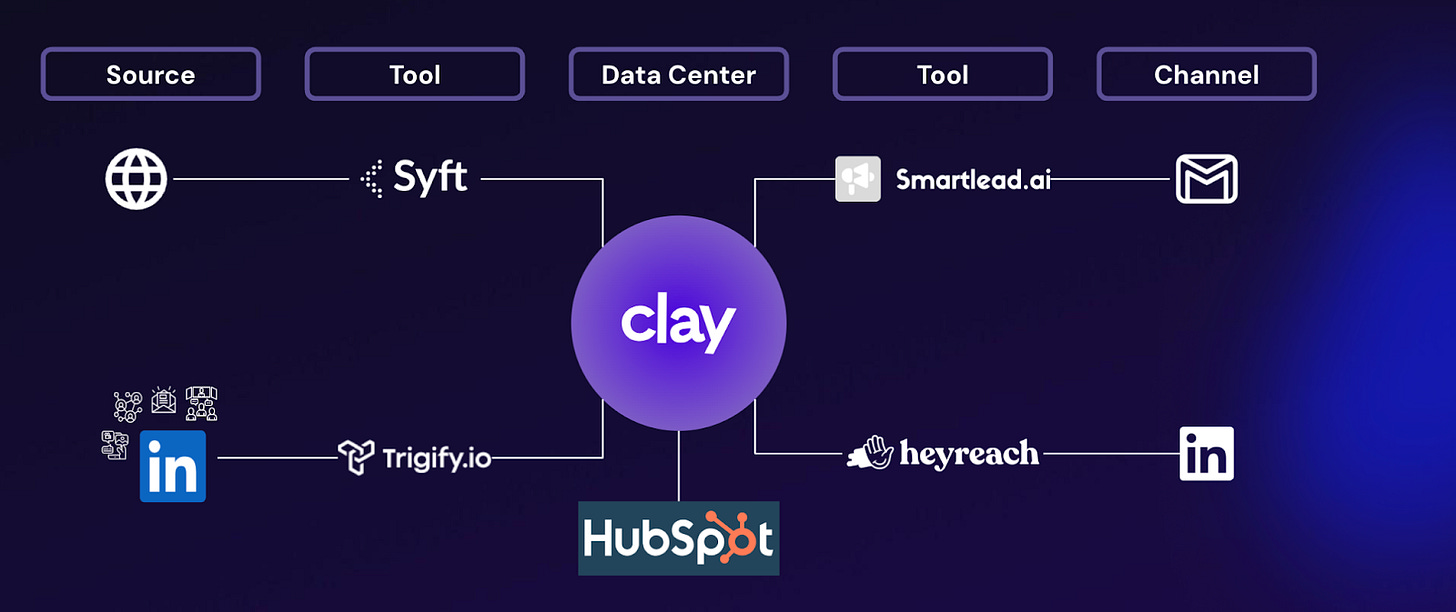

Below, you see a simplified visual of how the TechStack works together:

Syft & trigify pick up signals on the website and LinkedIn (based on your demand gen strategy), which are pushed to clay.com

Clay processes the signals and enriches contact data if required, and also syncs and looks up data in HubSpot/CRM (e.g., your do not contact list). Clay pushes relevant leads into a campaign.

Smartlead & heyreach send out an email, LinkedIn message, or simply a connection request. Alternatively, you can create a task in your CRM instead of automated outreach.

Again, if you are running a high-touch GTM motion, you may only have a couple of hundred accounts in your total addressable market. Rather than sending an automated email, you want to create a task for your Account Executive to reach out personally.

Component 5: Outreach

The final component is outreach. The whole Outreach is worth a guide itself, so we won’t go into details on it in this guide and rather link to some great, existing resources where you can learn more about the different subtopics:

Ultimate Cold Outbound Guide

Now that you know all the components of allbound pipeline generation, let's review some specific playbooks that might be relevant for you.

4 Highly relevant Allbound Playbooks (Step-by-Step)

Now that you know how Allbound works, we want to share with you step-by-step how to capture the required signals and build the clay.com workflows to AI-automate and process these signals.

(If clay seems a bit overwhelming at first, you can start by focusing on capturing signals and later move on to the clay automations.)

Let’s dive into 4 highly relevant Allbound playbooks for your SaaS, including:

🔄 LinkedIn Engagement Playbook

Hypothesis: People engaging with your LinkedIn content are more likely to buy your product and be responsive to outreach from you.

Purpose: Automate outreach to people who are starting to interact with your LinkedIn content and/or your competitor's content.

👀 Website Visitors Playbook

Hypothesis: People visiting your website have shown active interest in your solution and are more receptive to personalized outreach.

Purpose: Identify and engage website visitors with relevant, timely follow-up based on the specific pages they viewed.

🔍 Champion Tracking Playbook

Hypothesis: When your champions change companies, they're likely to bring your solution with them to their new organization.

Purpose: Track job changes of your advocates and customers to create warm expansion opportunities at their new companies.

🔎 Key Buyer Persona Hiring Playbook

Hypothesis: Companies hiring for specific roles related to your solution are actively looking to solve problems your product addresses.

Purpose: Monitor companies that recently hired a buyer persona for whom your solution is relevant.

Let's jump right into capturing signals for these 4 playbooks.

Playbook 1: 🔄 LinkedIn Engagement Playbook

Purpose: Automate outreach to people who are starting to interact with your LinkedIn content or your competitor's content.

How it’s done:

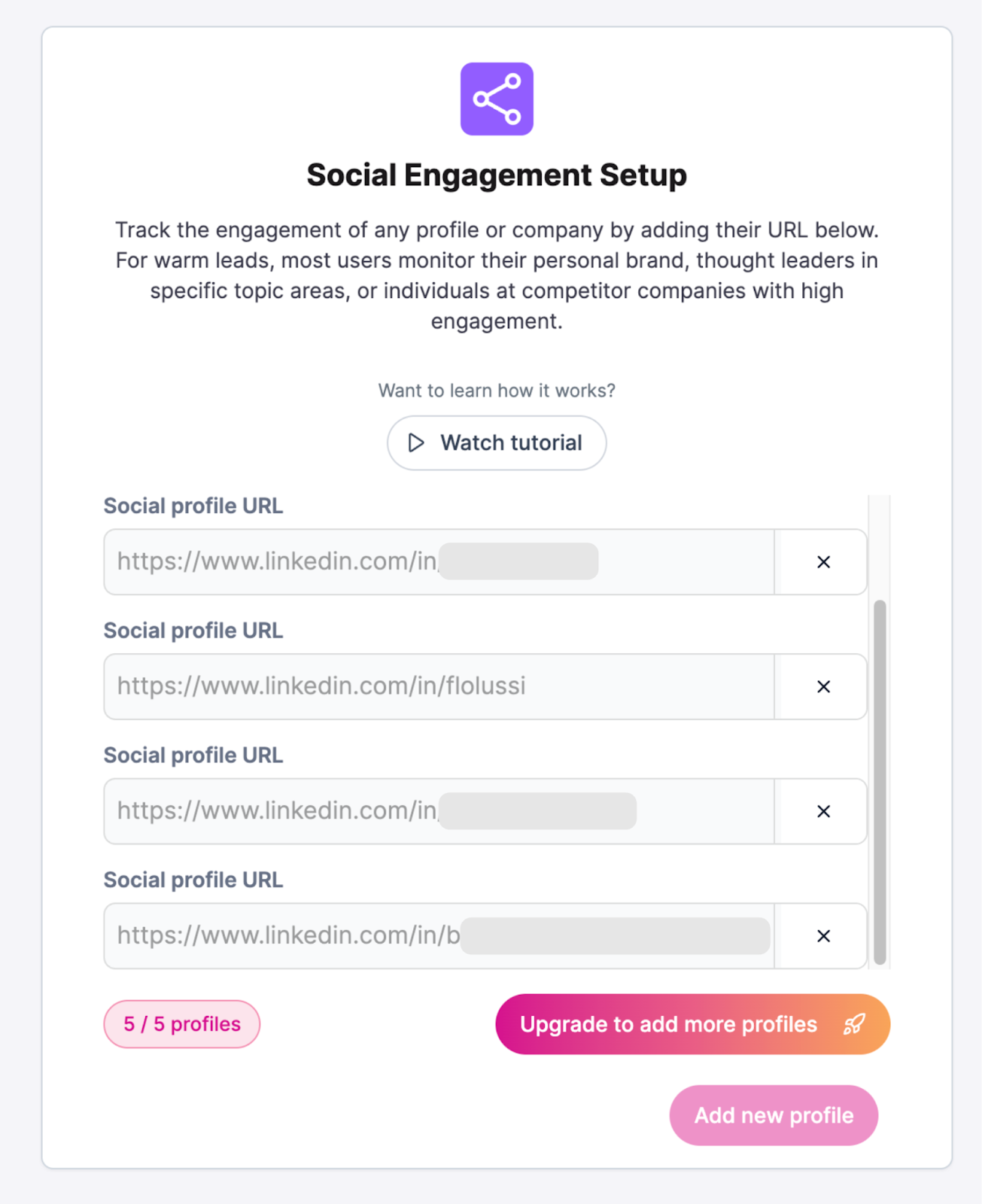

Get an account with trigify.io

Start tracking the profiles that are relevant to you, including your own profile, competitor profiles, and industry thought leader profiles.

Start tracking LinkedIn Engagement.

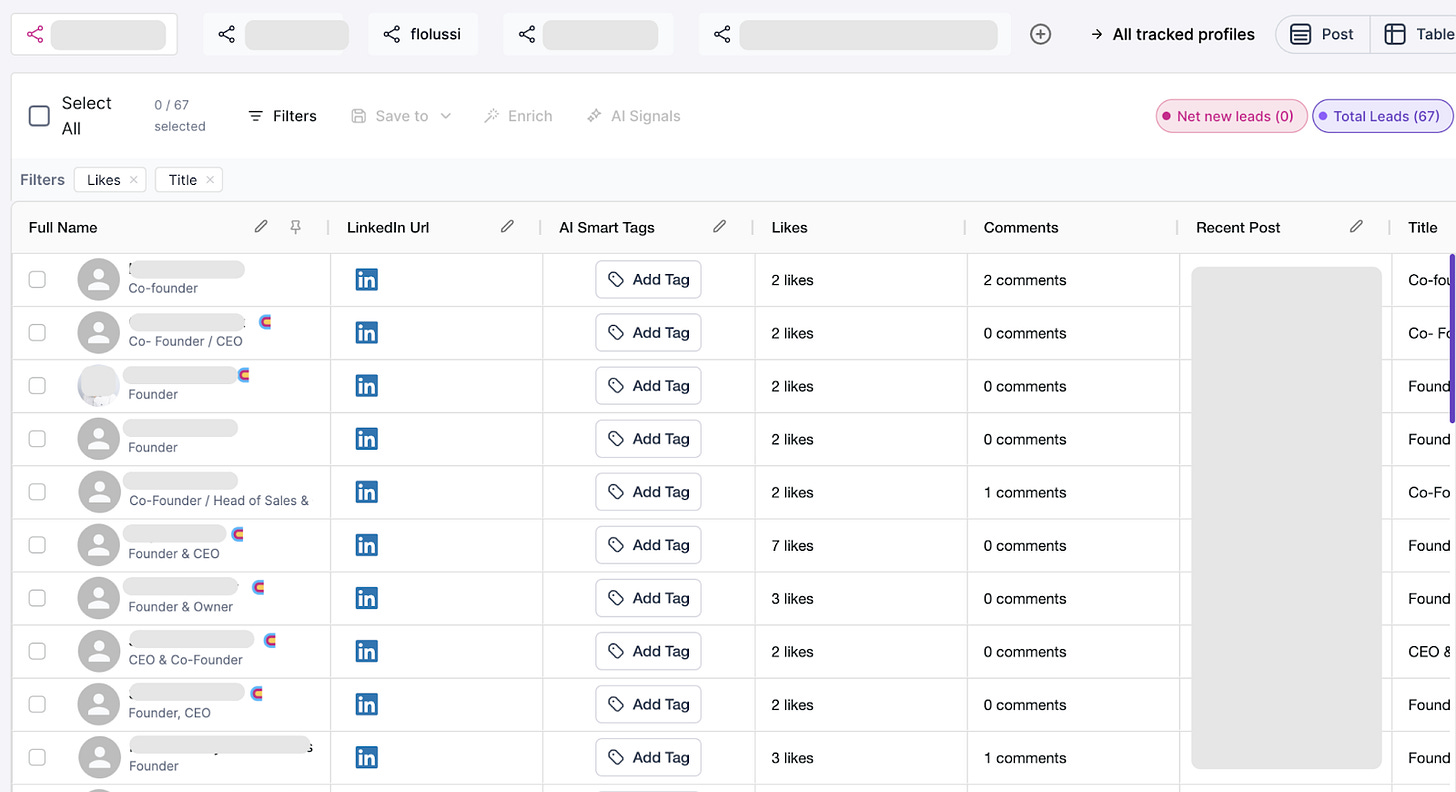

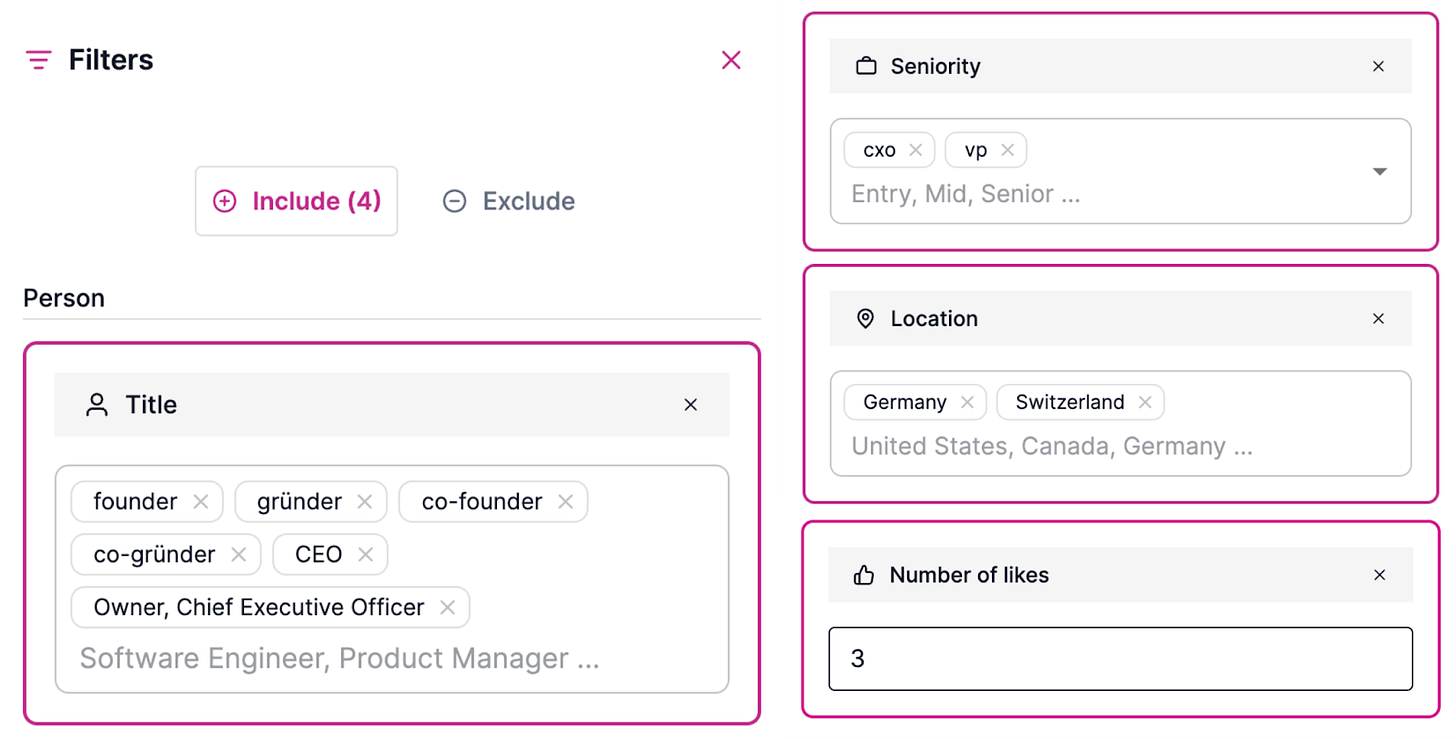

Filter for relevant buyer personas including job title, seniority, location etc.

Bonus Tips:

Number of likes: Define a minimum threshold of 3 LinkedIn engagements (likes & comments) to ensure some relevancy.

Clay: I prefer to do much of the filtering & qualification in clay.com to get more accuracy. However, if you only use trigify, the filtering is useful.

Auto-push LinkedIn engagement to clay or start outreach campaigns with Lemlist, Heyreach, Instantly, or Smartleads, or start engagement manually.

Bonus: How to engage with LinkedIn engagement?

We will show you 2 different approaches as inspiration.

Approach 1: Engagement with your personal content

When someone engages with YOUR content 3+ times:

Initial response: Thank them specifically for engaging with your particular post

"Hey [Name], I noticed you liked my post about [specific topic]. Thanks for the engagement! What part resonated most with you?" or “Hey [Name], I liked your comment on my post about [topic]. Are you currently working on [relevant challenge or solution]?"Value-add follow-up: Share additional relevant information

"Since you found that interesting, you might also enjoy this [resource/article] that dives deeper into [related topic]."Relationship building: Ask about their experience with the challenge your content addresses

"I'm curious - have you been facing similar challenges with [problem your solution addresses] at [their company]?"

Depending on your GTM motion and the buyer person you are selling to, you can also go much more direct and ask for a call:

Direct Approach:

“Hey [Name], I noticed you've been engaging with content about [topic]. We've helped similar [company specifics] companies in [country/industry] to [usecase] - resulting in [positive results]. If this sounds interesting, I'd be happy to [soft value-first offer] - no strings attached.”

→ Example: Hi Alex, I noticed you've been engaging with content about B2B Pipeline Generation. We've helped similar mid-market companies in Germany cut SDR costs by 215% while boosting pipeline by 150%. If this sounds interesting, I'd be happy to assess your current pipeline generation approach and create a 3-month execution plan to achieve similar results - no strings attached.

Approach 2: Engagement with Competitors’ & Thought-Leaders’ Content

Strategic approach: Rather than direct outreach, route these prospects to a LinkedIn connector campaign. This will likely expose them to your LinkedIn content in the future.

Playbook 2: 👀 Website Visitors Playbook

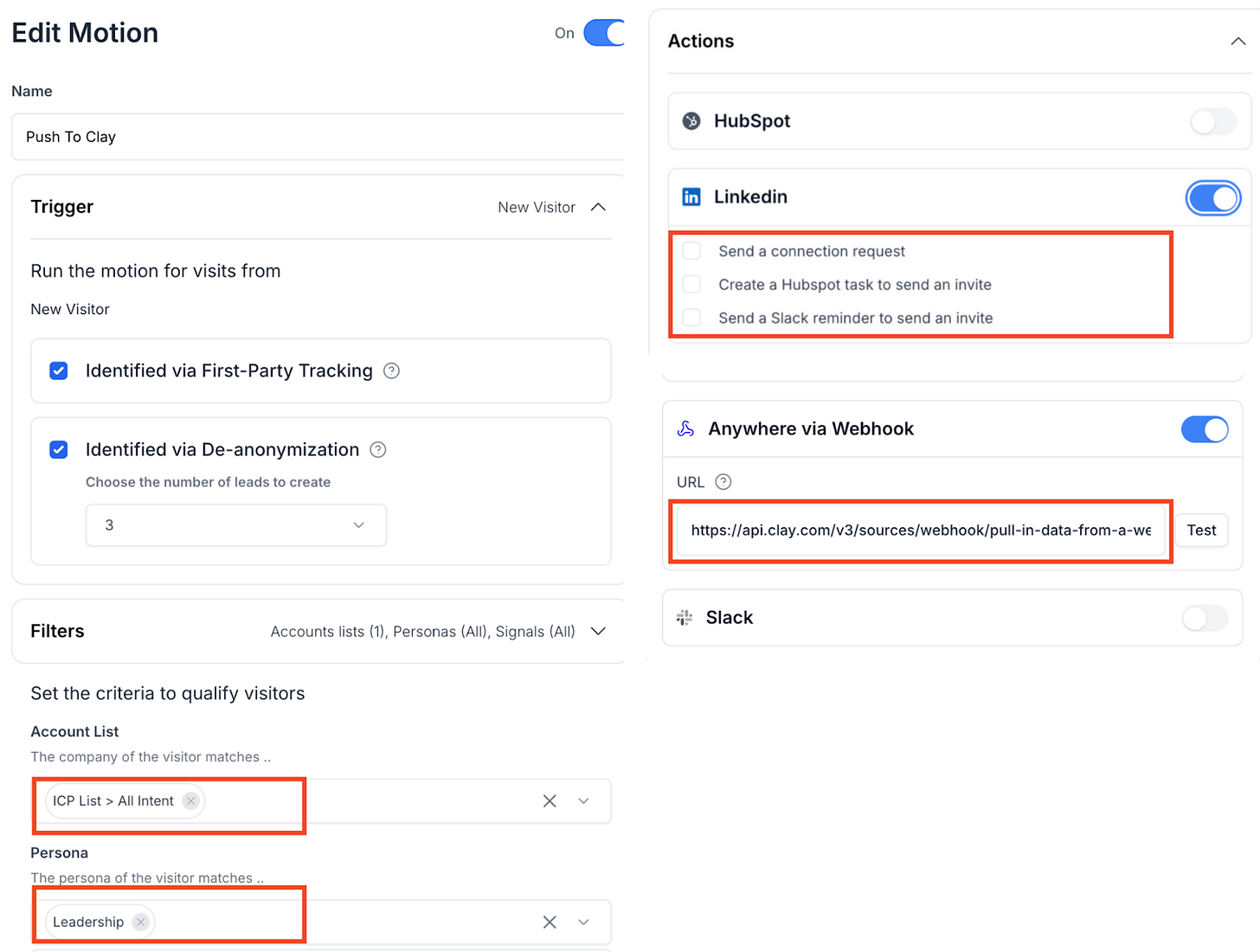

Purpose: Identify and engage website visitors with relevant, timely follow-up based on the specific pages they viewed.

How it’s done:

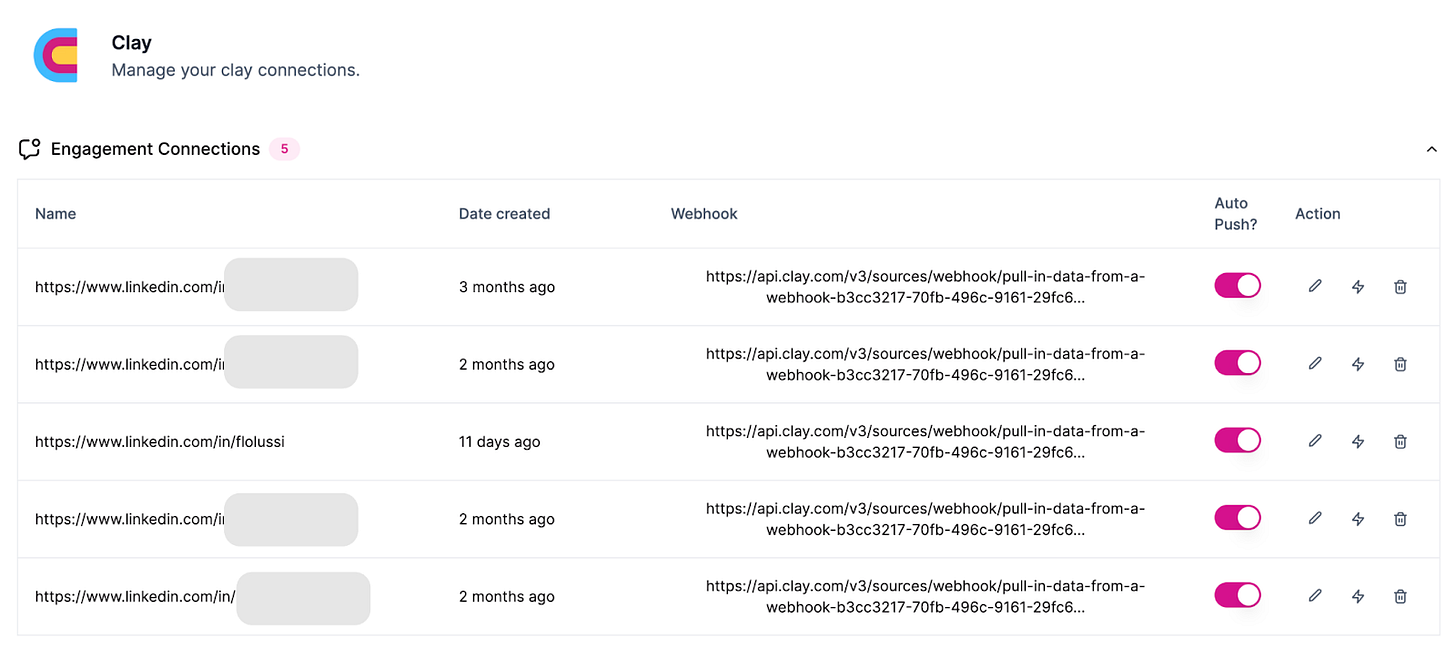

Get an account with syftdata.com (person-level identification)

Install GDPR-compliant tracking (code) on your website.

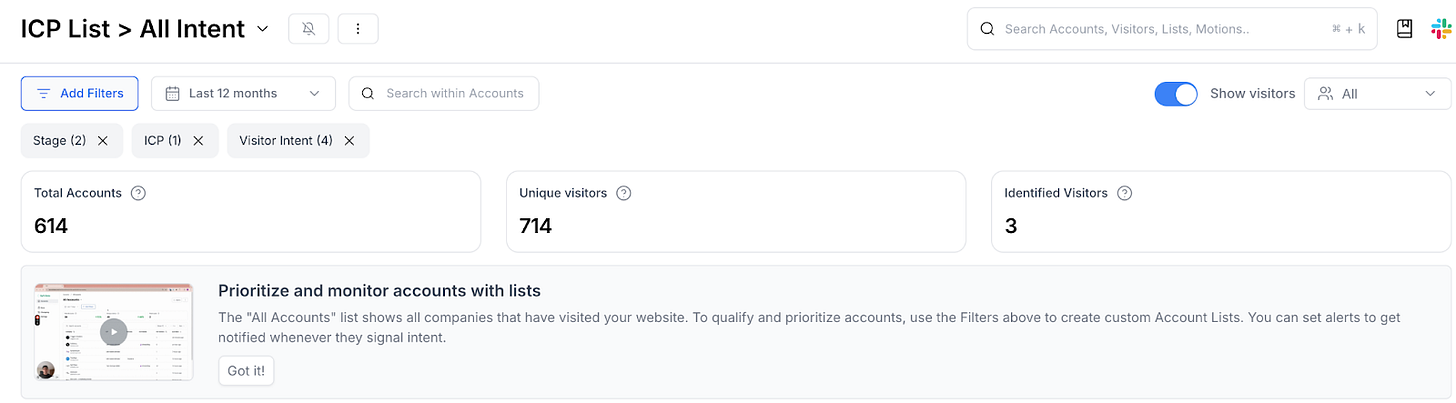

Start understanding which accounts are visiting your website for how long.

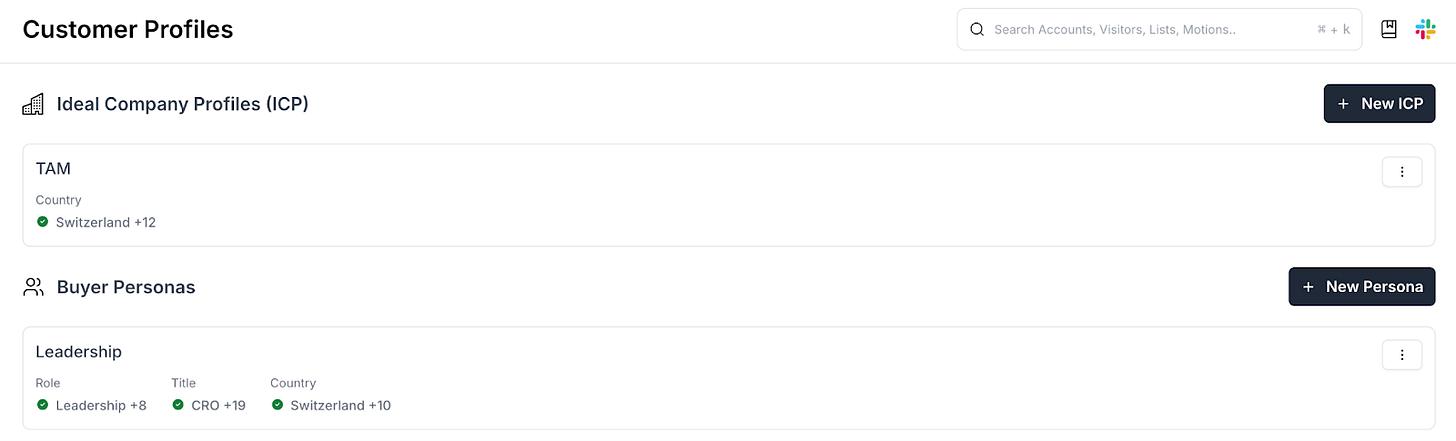

Set up your customer ICP and Buyer Persona Profile.

Create a “list” to filter for your specific criteria, such as intent-level, CRM Stage (e.g. do not show companies that are currently a customer or at an opportunity stage)

Auto-push filtered website visitors to clay. Or push to HubSpot, Slack, start outreach manually, or natively integrate with Smartleads (no native integration to Heyreach and Lemlist at the moment).

Bonus: How do you engage with website visitors? This again depends on your GTM motion and website volume:

Very-High Intent: Get on the phone and call + send a LinkedIn connection request.

High Intent: Send a personalized message + send a LinkedIn connection request.

Low-Medium Intent: Send a LinkedIn connection request.

Playbook 3: 🔍 Champion Tracking Playbook

Purpose: Track job changes of your advocates and customers to create warm expansion opportunities at their new companies.

(You can also do this with Sales Navigator, but it’s more manual work than using Clay - see below).

How it’s done:

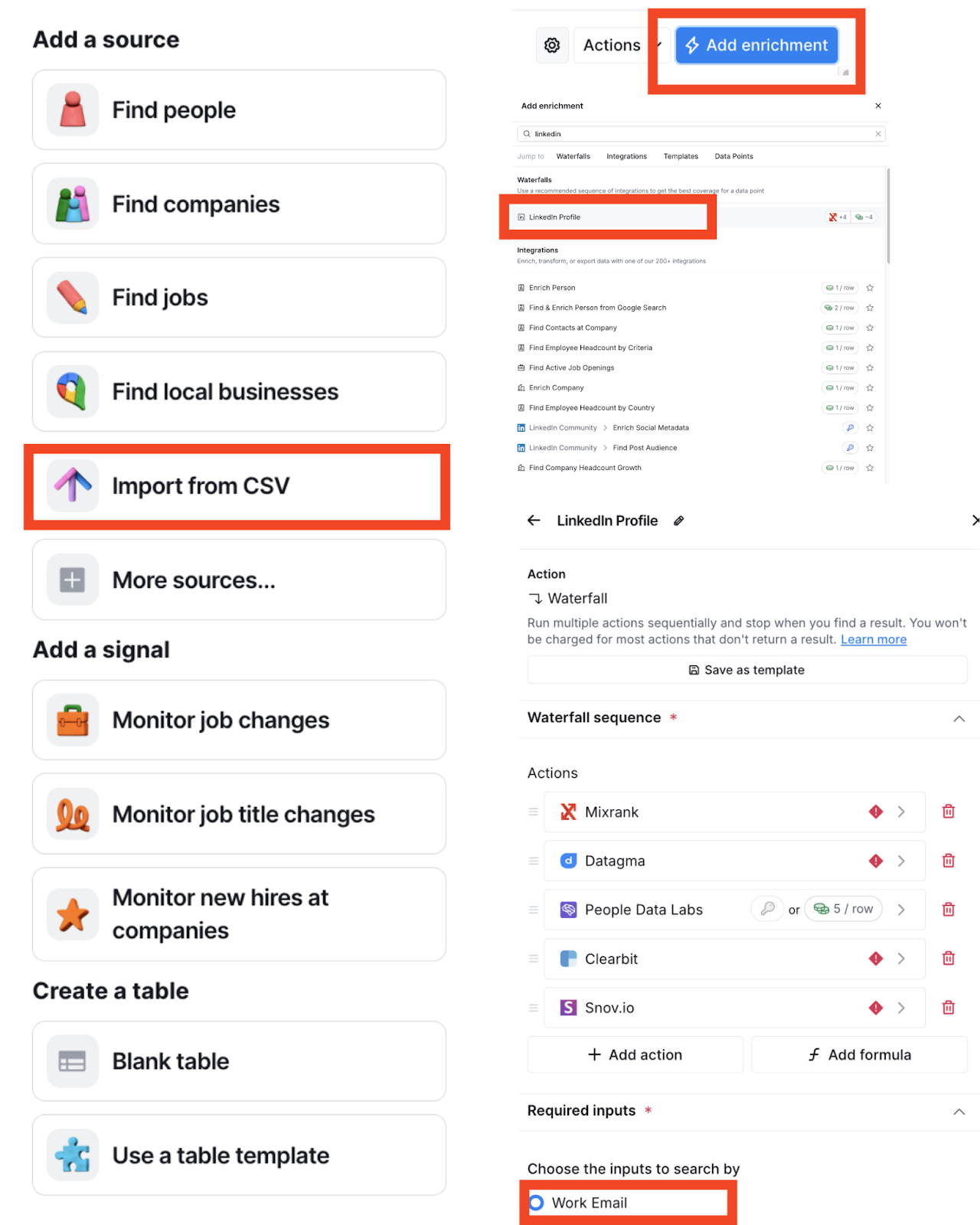

Get a clay.com account.

Import all customer email addresses from your CRM.

Click on “New” > “New Workbook”

Import CSV

Add enrichment

Search for LinkedIn Profile

Use Work Email

Enriched LinkedIn profiles of your customers.

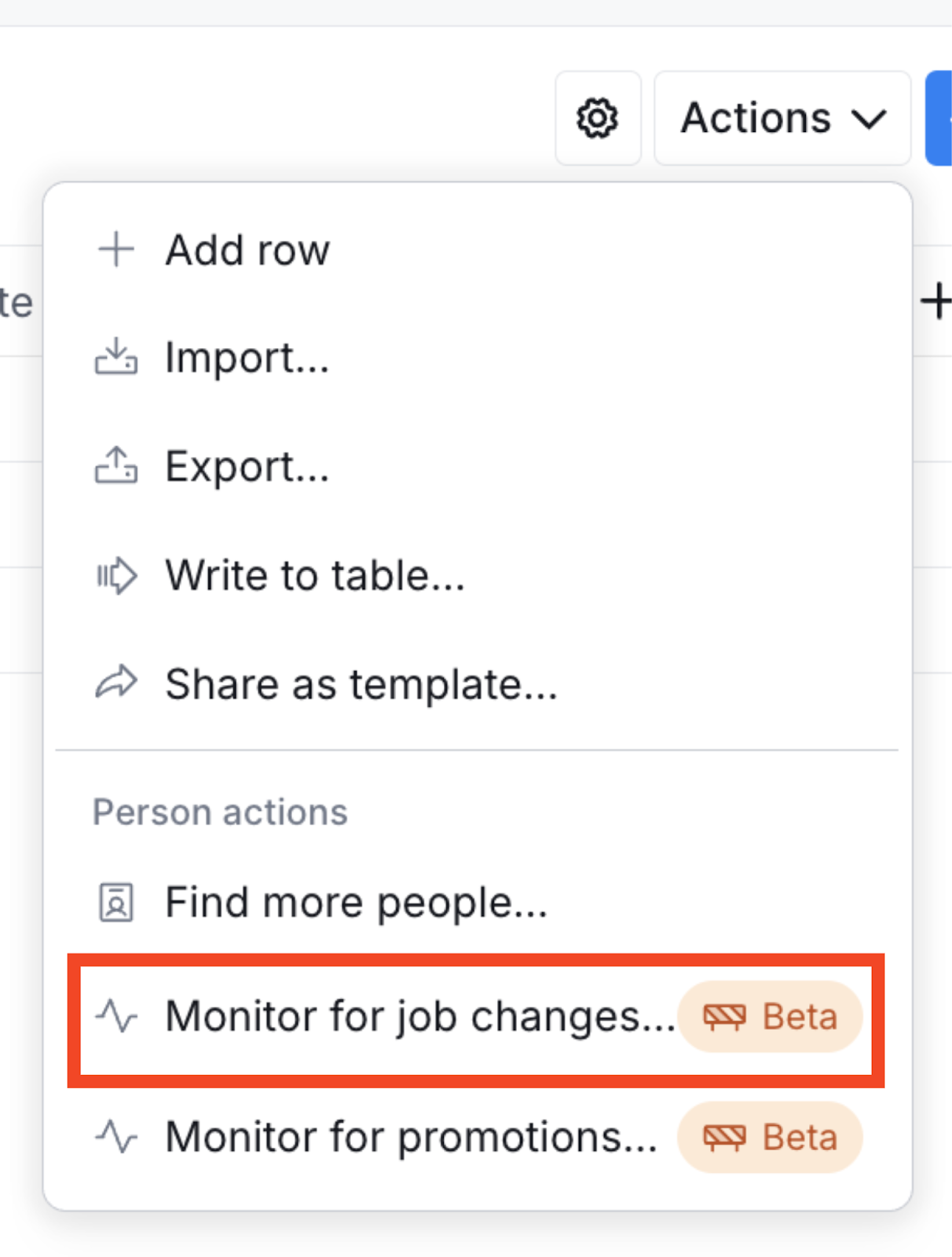

Start monitoring job changes of your customers and engage with them if relevant by clicking on Actions > Monitor for job changes.

Push into your campaign table in clay and then into your prospecting tools (e.g. heyreach, lemlist) or reach out manually.

Especially if you are running a mid-high touch sales motion, it’s recommended that you reach out personally, once you understand -

a) The new company is within your ICP

b) The new job is relevant.

Sometimes the new job is not directly related to the problem you solve, however, a warm introduction by a former customer often helps to get a foot in the door.

Playbook 4: 🔎 Key Buyer Persona Hiring

Purpose: Monitor companies that recently hired a buyer persona for which your solution is relevant.

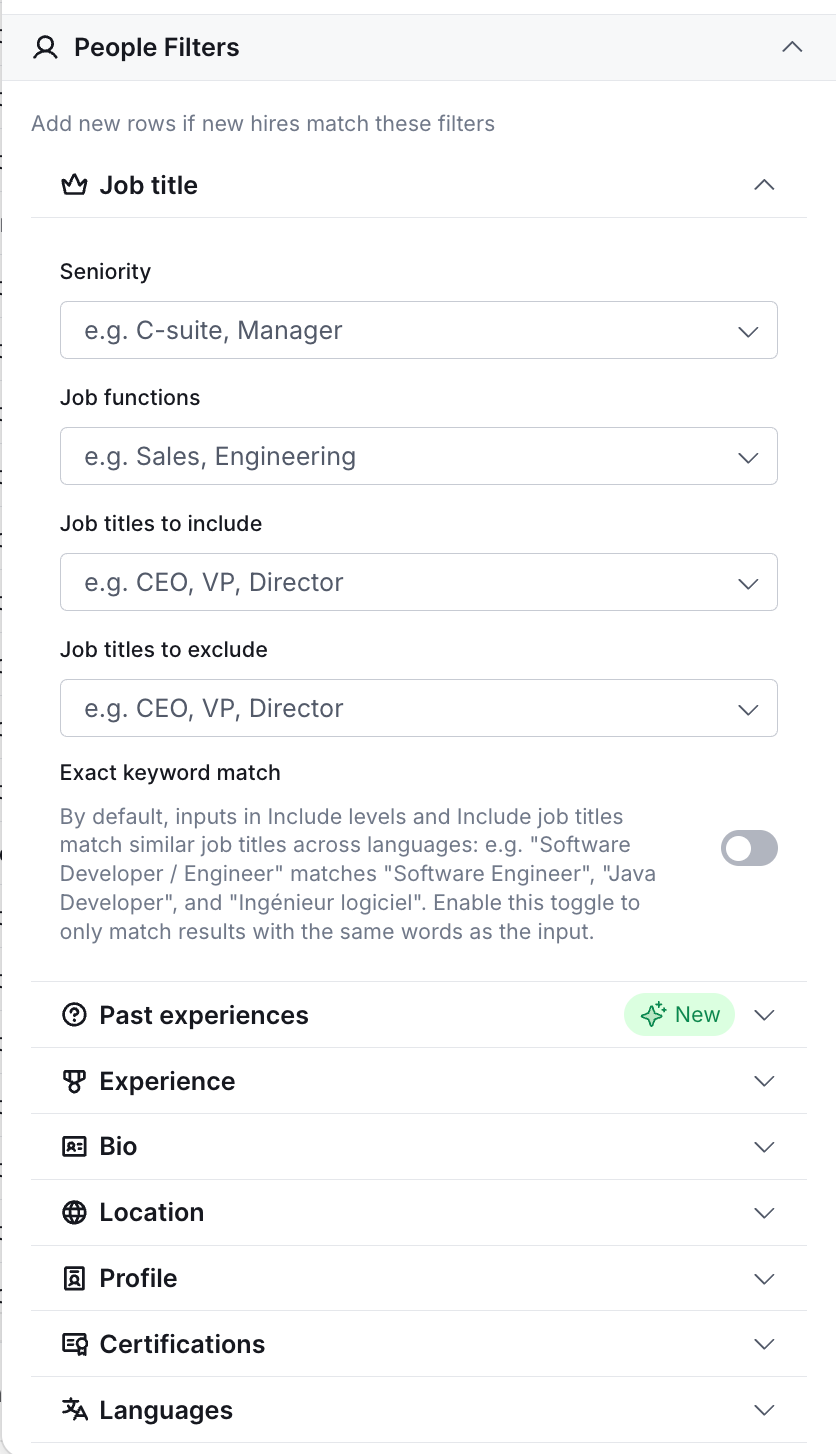

How it’s done: This is done very similarly to the “Champion Tracking Playbook” above.

Get a clay.com account.

Import the domains of the accounts you want to monitor.

Go to “Actions” > click on “Monitor for new hires”

Specify filters to only get relevant alerts. Alternatively, let AI decide whether it's a relevant profile or not.

Push into your campaign table in clay or reach out manually using one of the above frameworks, or send a LinkedIn connection request.

Now you know how you can run 4 powerful Allbound playbooks.

Yet they are NOT fully automated from signal detection to personalized messaging without ‘manual work’. For most early-stage founders, that level of automation is exactly right, because you will also handle a rather low volume.

However, if you want complete automation with AI, Florian and The Salesplaybook Team have a full section on how to automate Allbound with AI in their new Demand Generation 2025 Guide.

And if you want to get a 90-minute deep-dive session for free with the Salesplaybook Team, claim your session here. (Relevant for Companies with min. 500k€ ARR)

Happy growth 🚀

P.S. Get 3000 Clay credits for free 🎉