Ideal Customers: How to analyze your early customers to validate your ICP

5 Steps to Find your ICP and the Power of Niching Down 💪

Hey - it’s Alex, this time together with Daniel Zsolt Rényi!

Today we cover:

1️⃣ The WHY of Niching Down

2️⃣ How to Find Your ICP in 5 Steps: A Step-by-Step Process

3️⃣ Revamp your GTM with your (new) ICP

Bonus: List of my vetted Go-to software tools for early-stage SaaS startups

In case you missed the last 3 episodes:

✅ The Ultimate Founder-Led LinkedIn Guide

✅ 9 tactics to get your first 50 SaaS customers in 2025

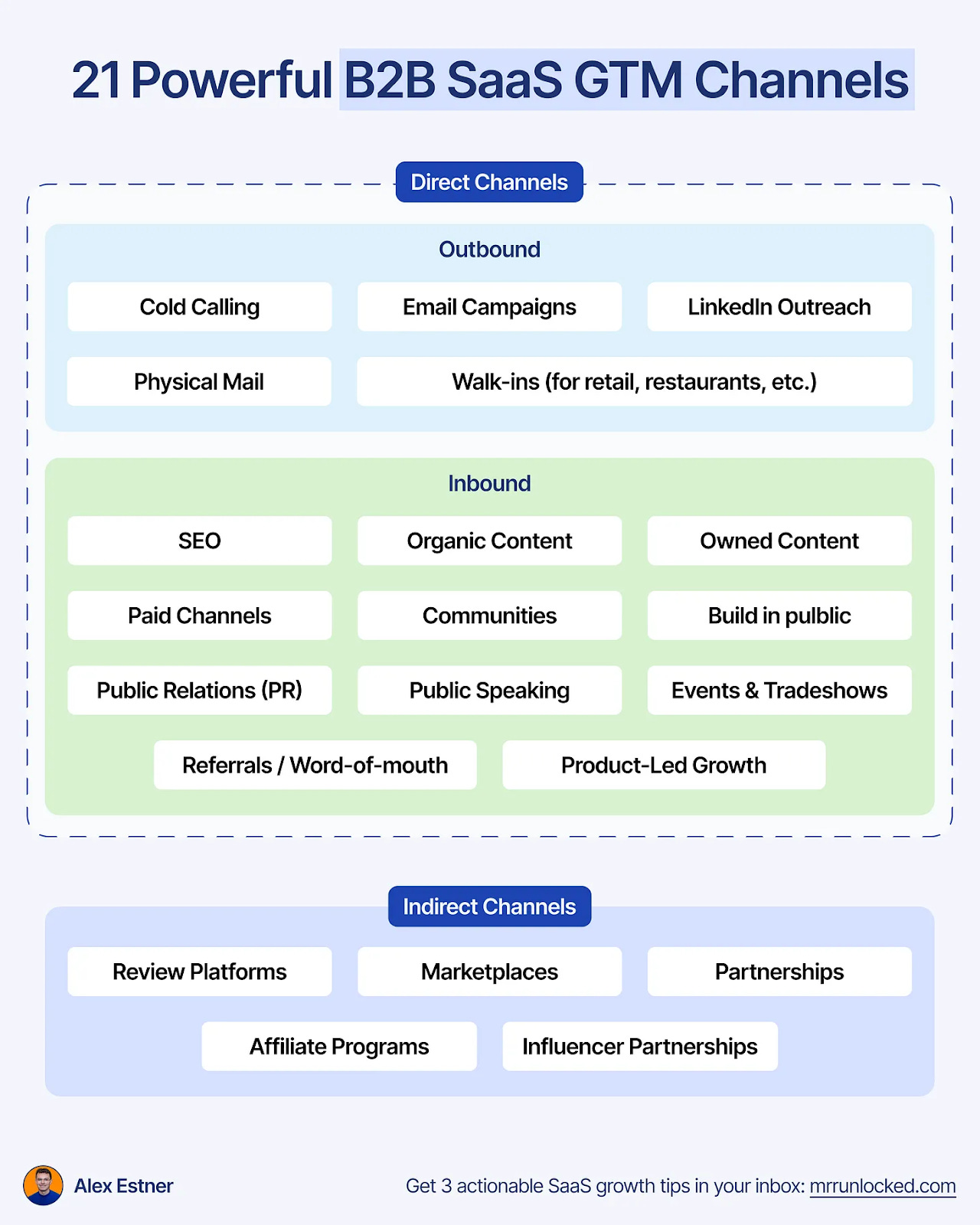

✅ The 21 GTM Channel to grow your SaaS

1️⃣ If you’re new to the newsletter: I share bi-weekly actionable SaaS GTM strategies and tactics that will help you grow your B2B SaaS business from €0 to €1 million ARR 🚀

2️⃣ If you enjoyed this post, share it with a friend to get my 100+ actionable SaaS growth tactics for free 🥁

3️⃣ Work 1-on-1 with me - GTM Advisory for early-stage SaaS founders on their way to €1 million ARR (1 free spot - limited to 8 founders).

4️⃣ Want to reach 4800+ early-stage SaaS founders/leaders? Sponsor the next newsletter.

👇This guide might be too long for your email inbox. So read the full guide here 👇

The WHY of Niching Down: A Counterintuitive Path to SaaS Growth

Here's a hard truth that most founders and marketing leaders don't want to hear:

“trying to sell to everyone who'll pay is the slowest path to 1€M, or at least the slowest to 10€M ARR”

We know, We know. Your product could help so many different types of companies. And turning down paying customers feels wrong, especially in the early days.

But here's the thing: the fastest path to meaningful growth isn't casting a wider net. It's going narrow and deep.

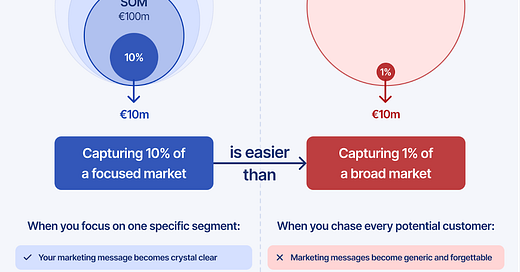

The Big Fish, Small Pond Strategy

Think about it this way. Would you rather be:

1️⃣A small fish fighting for survival in a big pond (aka. your TAM)

or

2️⃣a big fish in a small pond (aka. dominating a sub-segment of your SOM)

The math is simple. Let's say you're targeting a 100M€ market.

If you capture 10% of a niche, that's 10M€.

If you try to capture 1% of a 1B€ market, that's also 10M€

But here's the kicker: capturing 10% of a focused market is WAY easier than capturing 1% of a broad market.

Why? Because…

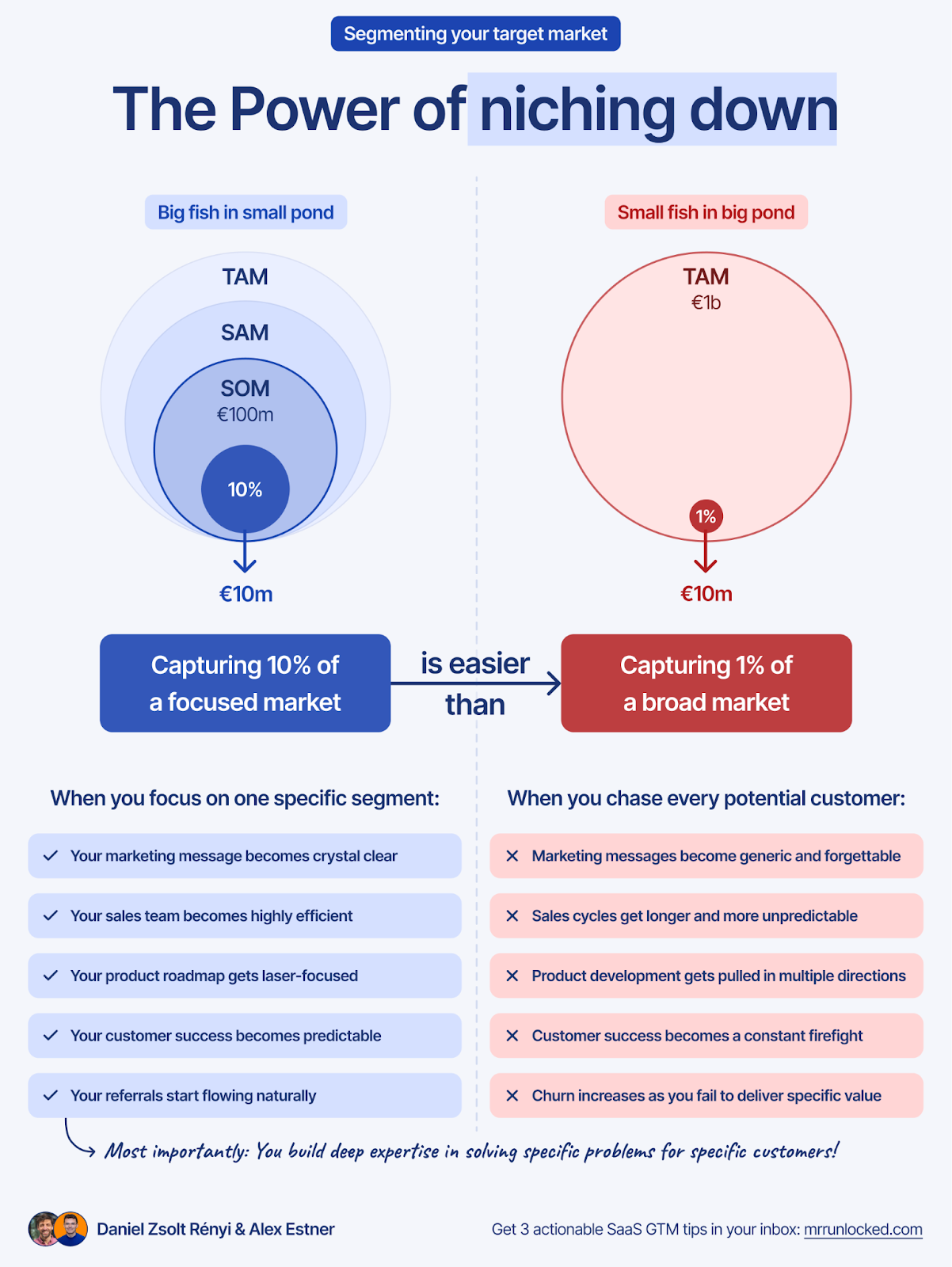

The Hidden Cost of Serving Multiple Segments

Serving multiple different segments at the same time is time and resource-intensive.

Each customer segment you serve requires its own:

Value proposition & messaging

Sales playbook

Product features

Support processes

maybe even skills & talents

etc.

And that's just the tip of the iceberg.

Additionally, every time you add a new segment, you build a new GTM motion.

Each motion requires:

Different sales approaches

Different success metrics

And guess what? Your small team can't execute multiple GTM motions effectively. You'll end up doing everything poorly instead of one thing exceptionally well.

Here's what happens when you chase every potential customer:

❌Marketing messages become generic and forgettable

❌Sales cycles get longer and more unpredictable

❌Product development gets pulled in multiple directions

❌Customer success becomes a constant firefight

❌Churn increases as you fail to deliver specific value

Neither fun, nor desirable.

The Power of Focus

The path to 1€ and then to 10€M ARR isn't about maximizing your total addressable market.

It's about dominating a specific segment.

When you focus on one specific segment:

✅Your marketing message becomes crystal clear

✅Your sales team becomes highly efficient

✅Your product roadmap gets laser-focused

✅Your customer success becomes predictable

✅Your referrals start flowing naturally

Most importantly, you build deep expertise in solving specific problems for specific customers.

This expertise compounds over time, creating a moat that competitors can't easily cross.

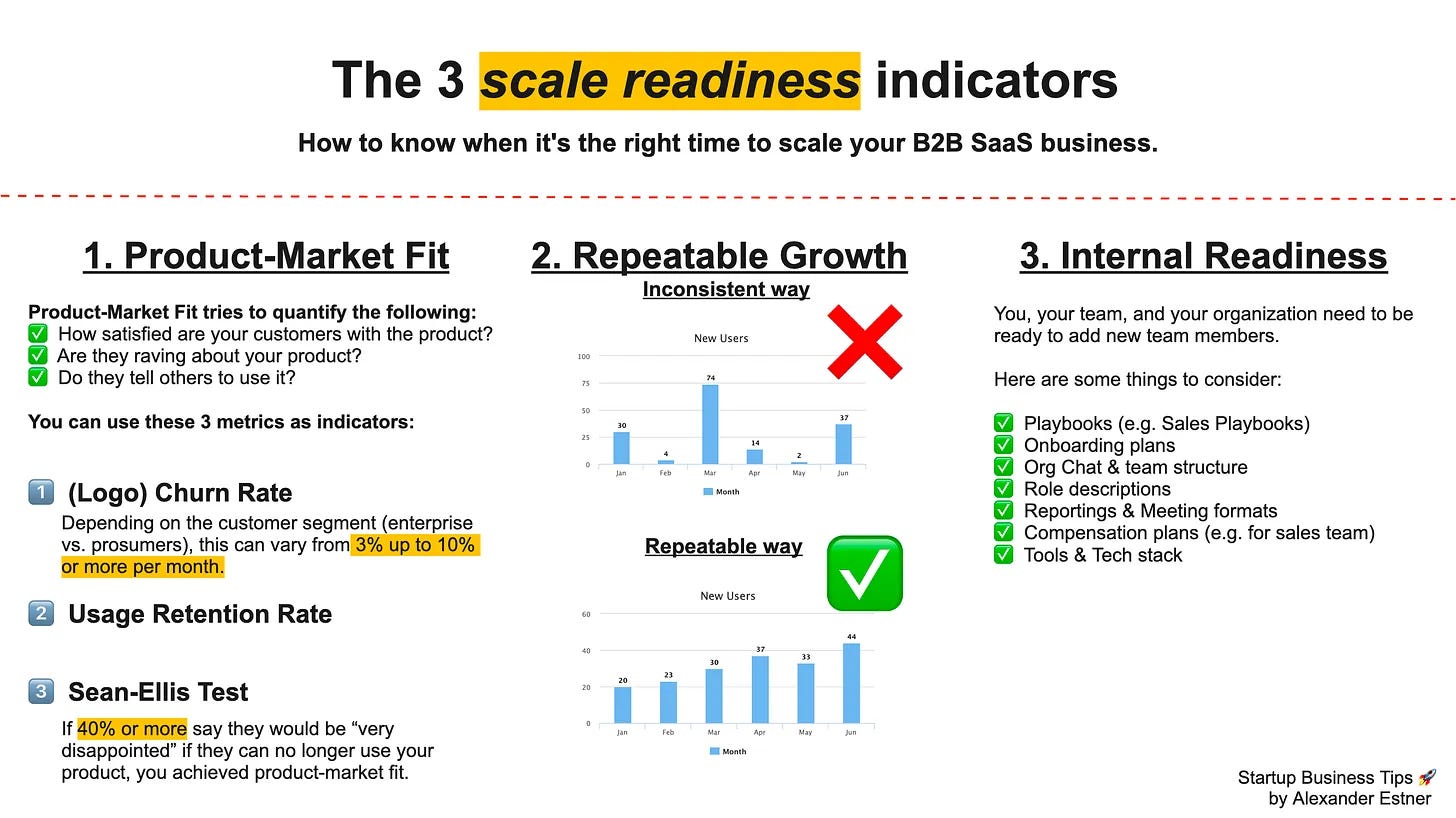

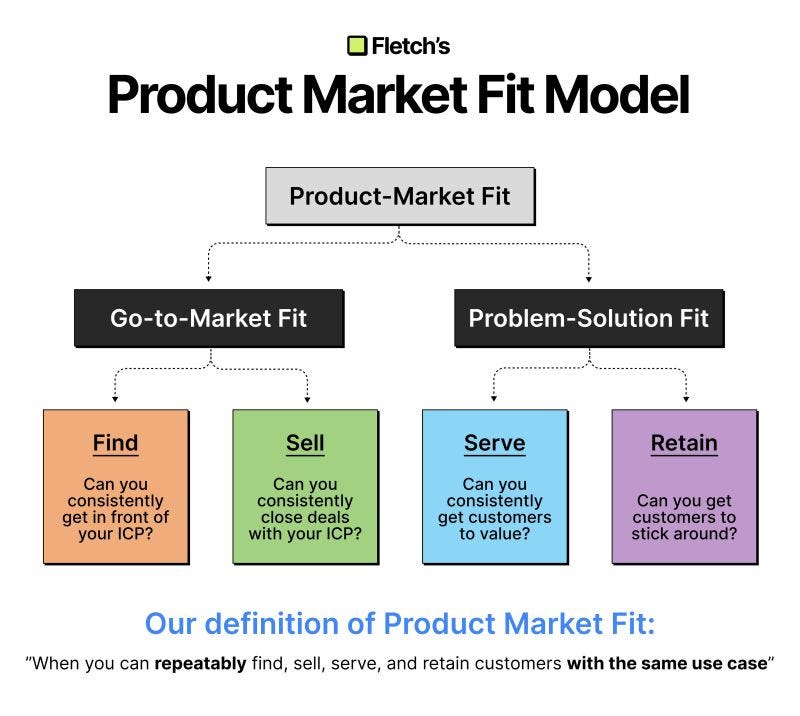

Which will ultimately bring you to the point of predictable & repeatable growth.

Or as Robert & Anthony call it: Product Market Fit.

And once you ‘dominate’ this specific slice of the market. You have 2 expansion options:

1️⃣Vertically (same target audience (aka. ICP), but new use cases)

or

2️⃣Horizontally (same use case, but new target audiences)

But first, you need to prove you can win decisively in one space.

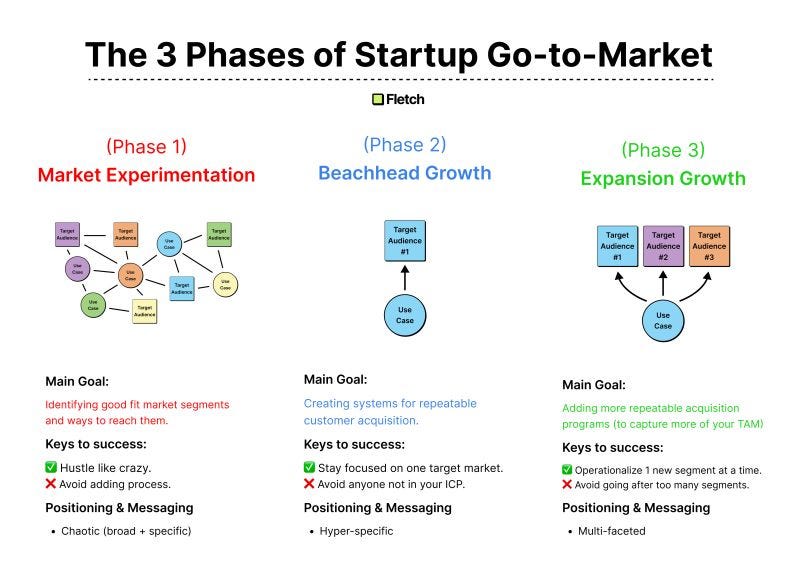

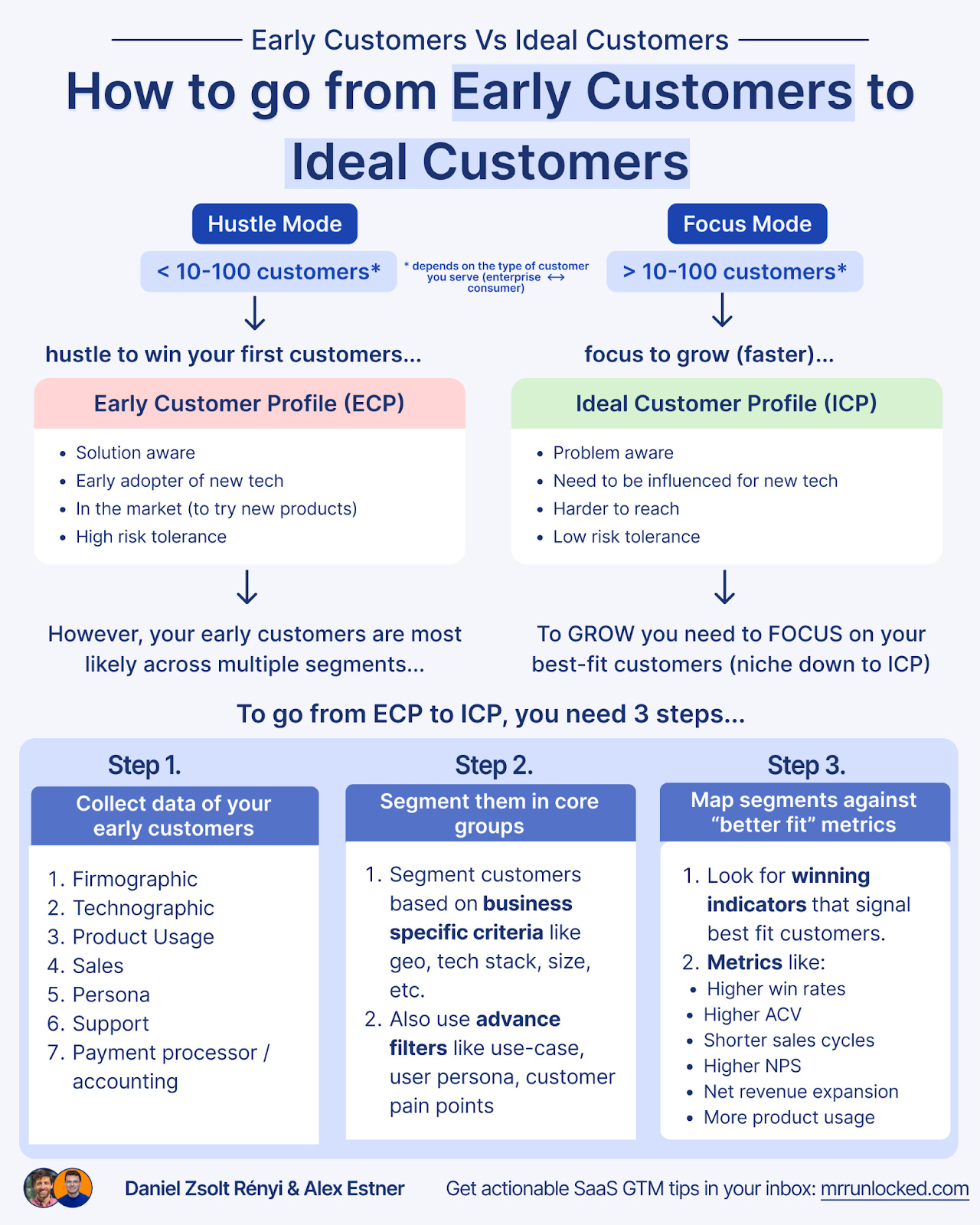

And this all starts with phase 1: The ‘hustle’ mode.

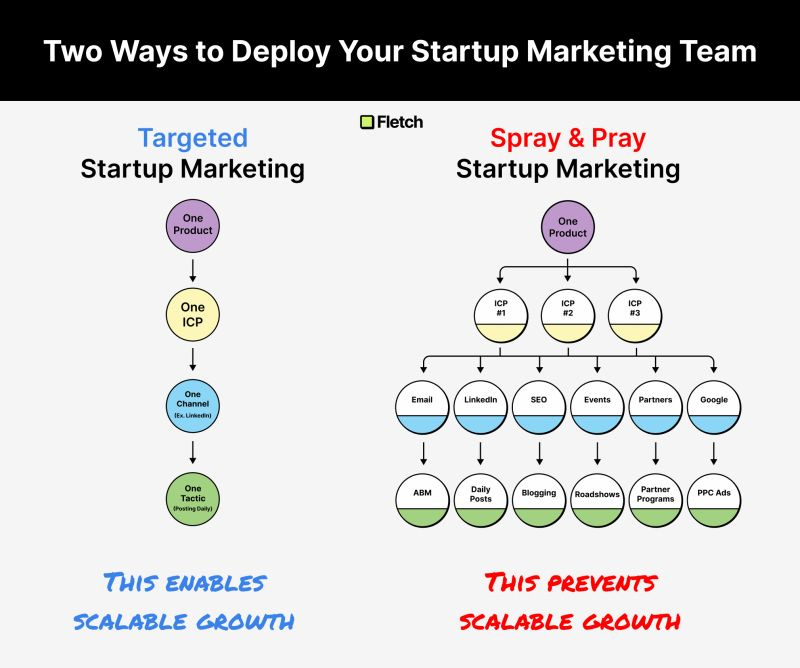

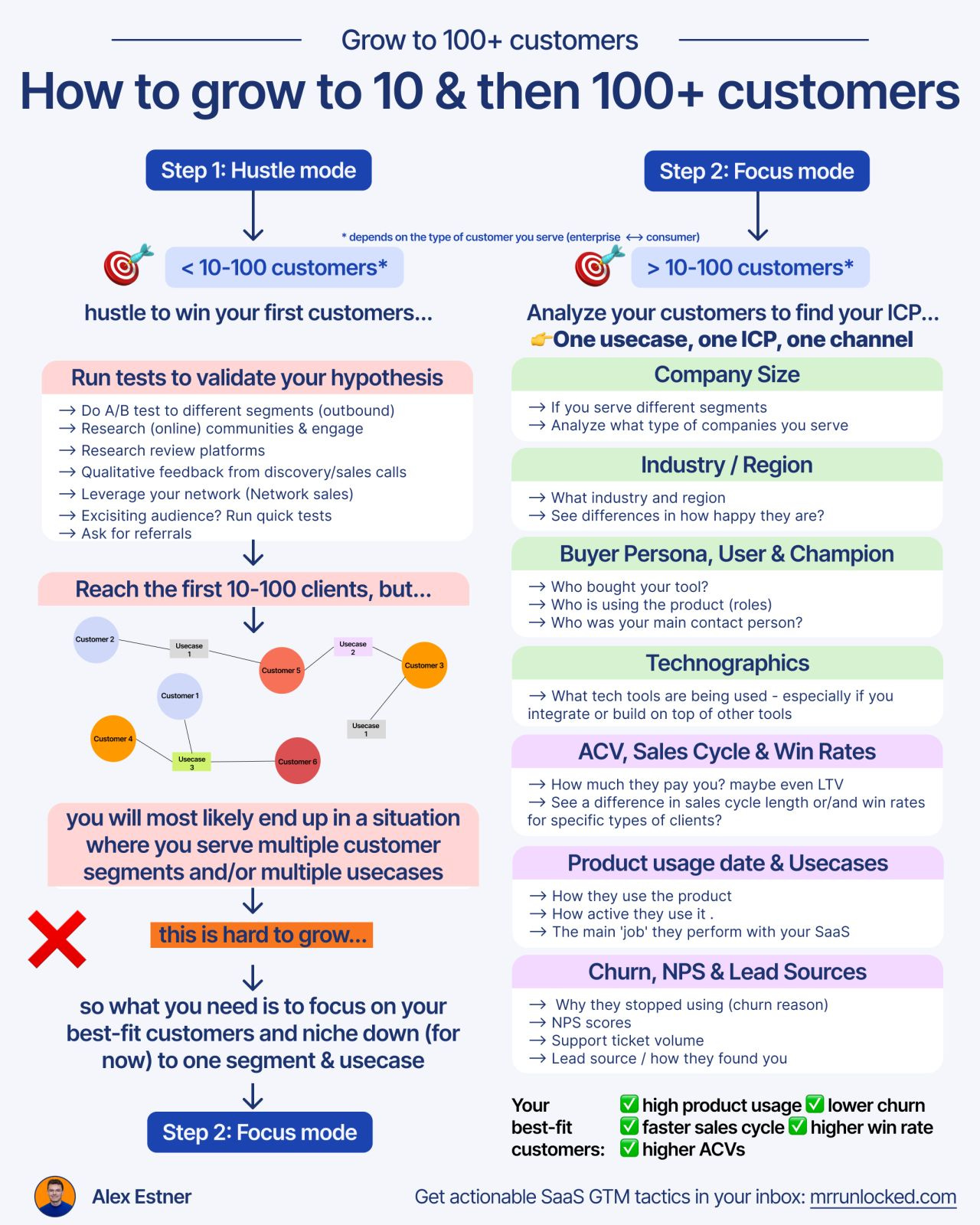

Hustle Mode: Get Your First 10-100 Customers

We call it the ‘hustle mode’ phase, others call it the ‘Market experimentation’ phase.

Hustle mode is where you’re throwing everything at the wall to see what sticks. You’re chasing your first paying customers, testing hypotheses, and figuring out who’s willing to swipe their credit card.

And that’s fine. For a while.

At this stage, you’re not overanalyzing. You’re not building complex data dashboards or running segmentation experiments. You’re just trying to get customers in the door. It’s messy, it’s scrappy, and it’s necessary.

But here’s the thing: hustle mode should only last so long.

These initial customers are your ECPs (Early Customer Profile). They tend to be rather:

✅experimental,

✅and in the market.

They are most likely different from your Ideal Customers (ICPs) - your ultimate goal.

Your ICPs tend to be:

❌not yet solution aware,

❌require proof of work and

❌hard(er) to reach.

You can see the difference between early customers & ideal customers in this visual.

Once you’ve landed your first 10-100 customers (depending on your ACV, more on that below), it’s time to stop and think. And start analyzing.

Why?

Because not all customers are created equal. Some will be a great fit for your product and vision; others will drain your resources and churn faster than you can say “customer success.”

You need to refine your ECPs and work your way up to your ICP.

The sooner you identify the *right* customers, the sooner you can focus all your energy - and budget - on pulling more of them in.

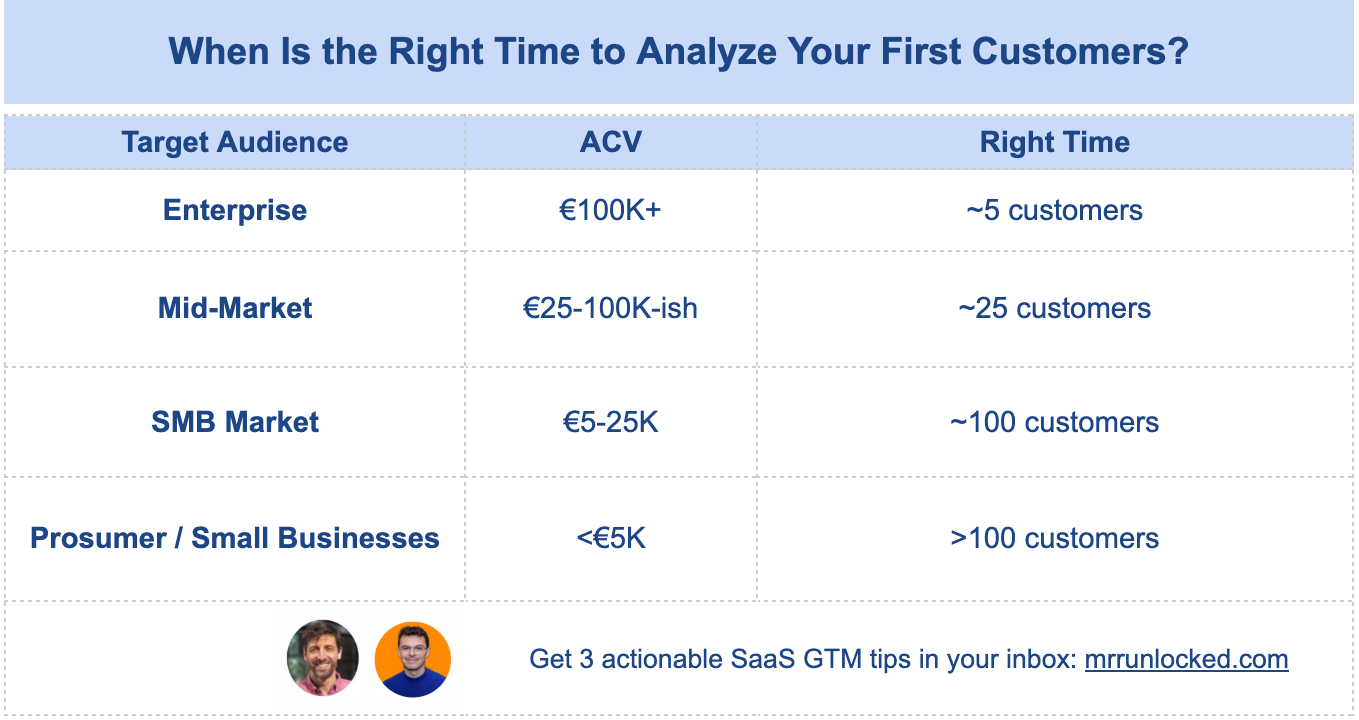

When Is the Right Time to Analyze Your First Customers?

Timing matters.

You don’t want to start analyzing:

❌too early: not enough data

or

❌too late: you’ve already wasted resources on bad-fit customers

The right time depends on your target audience and average contract value (ACV):

Selling to:

1️⃣Enterprise with a high ACV of 100k€+:

Start analyzing after 5-ish customers. Truth is, you’re not going to have very many €100K+ ACV won deals, so you’re left to make assumptions with a low sample size.

2️⃣Mid-Market with ACVs from 25-100€K-ish:

Aim for 25 customers before diving into analysis.

3️⃣SMB Market with ACVs from 5-25k€:

Aim for around 100 customers

4️⃣Prosumer / small businesses with ACVs up to 5k€:

You should have min. 100 customers

The more data the merrier, a sample size of 100 becomes statistically relevant.

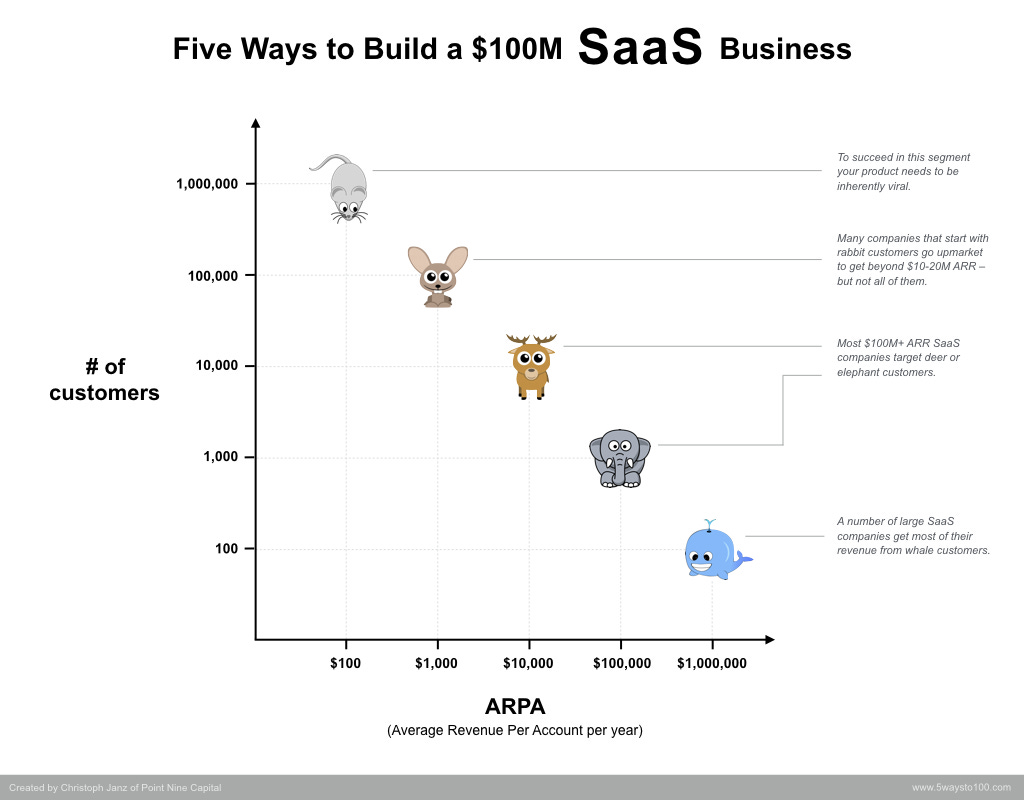

💡Good Reminder: 5 ways to build a 100€ million ARR SaaS business

The Art And Science Of ICP Discovery

Just a heads up before we dive into the process.

There is an art and a science to finding your ICP.

The art aspect refers to the qualitative components that go into the pot:

✅ past experience,

✅ intuition and

✅ personal preference (about the types of companies/people you want to serve)

These are important components and shouldn't be overlooked. When setting out to do this, you’ll find yourself in one of three positions:

1️⃣You have a good idea of the types of businesses you need to be going after, or you can narrow down your possible ICPs to two or three segments.

This is especially true for large deal environments, where you have fewer customers and so, less data. You may also be in this position if you’ve had many customers already, but you’re pivoting and feel that data about your past deals are not relevant.

2️⃣Other times, especially in high velocity and low ACV environments, you will be sitting on a good amount of data, and everything we tell you about the quantitative process below is a lot more relevant.

3️⃣Then, there is a third scenario in our experience.

A founder will have a good idea of their ICP in our initial conversation. Then we look at more nuanced factors that go into shaping an ideal customer profile and dive into the data. This almost always proves to be a super-valuable process, because it refines and sometimes even overrides original assumptions and changes the game.

The magic is in blending qualitative factors with the process and data while knowing the limitations of each.

Enjoy the ride!

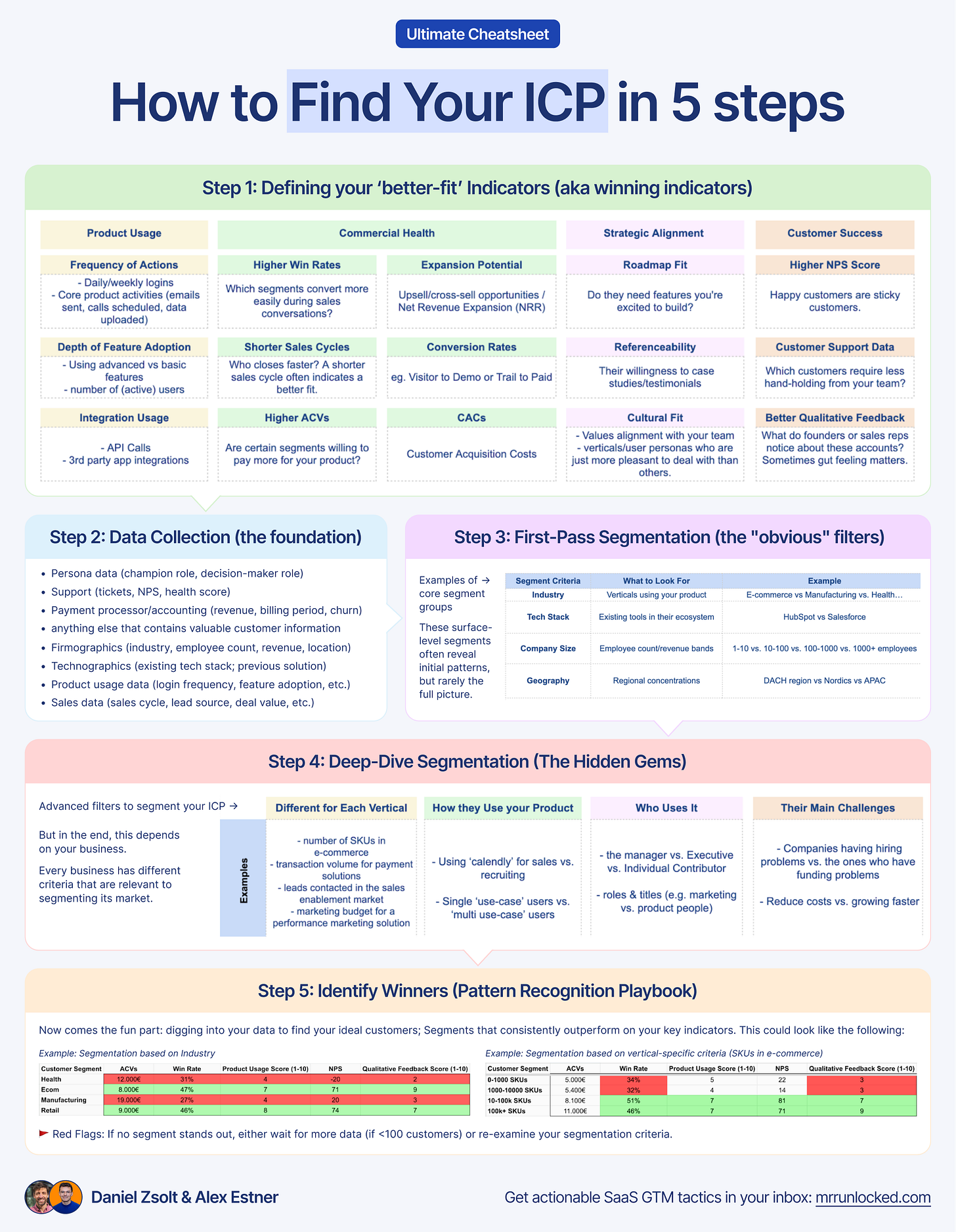

How to Find Your ICP: A Step-by-Step Process

Now that we know WHY and WHEN to analyze early customers, let’s jump into HOW you work your way to your ICP.

To validate your ICP, you need to:

1️⃣Collect data of your customers

2️⃣Break down your customer base into segments and

3️⃣Analyze them against metrics that are indicators of ‘better fit’

We call them ‘‘better-fit’ Indicators (aka. Winning indicators).

Let’s dive into the step-by-step process.👇

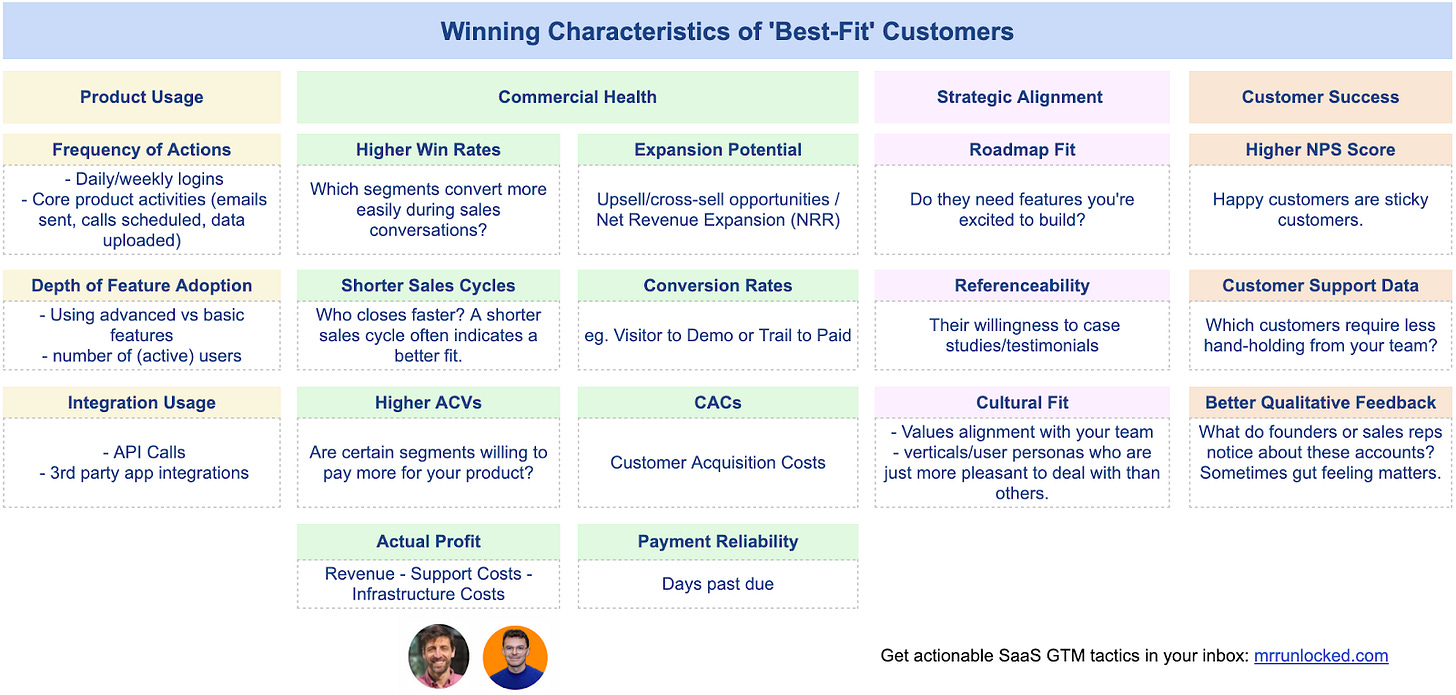

Step 1: Defining your ‘better-fit’ Indicators (aka. Winning indicators)

To know which customers are a ‘better fit’, you need to search for ‘winning indicators’.

We recommend looking for key indicators that signal those “best-fit” (aka. ideal) customers.

Usage Intensity / Product Engagement Indicators

Frequency of key actions (e.g., daily/weekly logins; core product activities (emails sent, calls scheduled, data uploaded)

Depth of feature adoption (using advanced vs basic features)

Integration usage (API calls, 3rd-party app connections)

These customers actively use your product, not just sign up and ghost you.

Commercial Health Indicators

Higher Win Rates: Which segments convert more easily during sales conversations?

Shorter Sales Cycles: Who closes faster? A shorter sales cycle often indicates a better fit.

Higher ACVs: Are certain segments willing to pay more for your product?

Actual Profit* = Revenue - Support Costs - Infrastructure Costs

Expansion potential (upsell/cross-sell opportunities) / Net revenue expansion (NRR)

Conversion Rates (e.g. Visitor to Demo)

Customer Acquisition Costs (CACs)

Payment reliability (days past due)

Strategic Alignment Indicators

Roadmap fit (do they need features you're excited to build?)

Referenceability (their willingness to case studies/testimonials)

Cultural fit (values alignment with your team. There might be verticals/user personas that are more pleasant to deal with than others.)

Customer Success Indicators

Higher NPS Score: Happy customers are sticky customers.

Customer Support Data: Which customers require less hand-holding from your team?

Better qualitative feedback: What do founders or sales reps notice about these accounts? Sometimes gut feeling matters.

* In case different segments have huge differences in support costs and infrastructure costs, think of analyzing actual profits.

Generally speaking, your ‘best-fit’ customers:

💪 have higher product engagement

💪 show better commercial metrics

💪 are less support intense

💪 are better aligned with your strategy and values/culture

Step 2: Data Collection - The Foundation for Segmentation

Surprise, surprise: you’ll need data. Head over to the relevant systems (help desk, CRM, product analytics, etc.) and collect as much information as possible (ideally, export 12+ months of customer data).

Try to Include the following data points (non-exhaustive list):

Firmographics (industry, employee count, revenue, location)

Technographics (existing tech stack; previous solution)

Product usage data (login frequency, feature adoption, product usage metrics, etc.)

Sales data (sales cycle, lead source, deal value, etc.)

Persona data (champion role, decision-maker role)

Support (tickets, NPS, health score)

Payment processor/accounting (revenue, billing period, churn)

anything else that contains valuable information about customers

*Bonus: You can do the same exercise for all your open & closed deals (lost & won) to also get a picture of the lost deals.

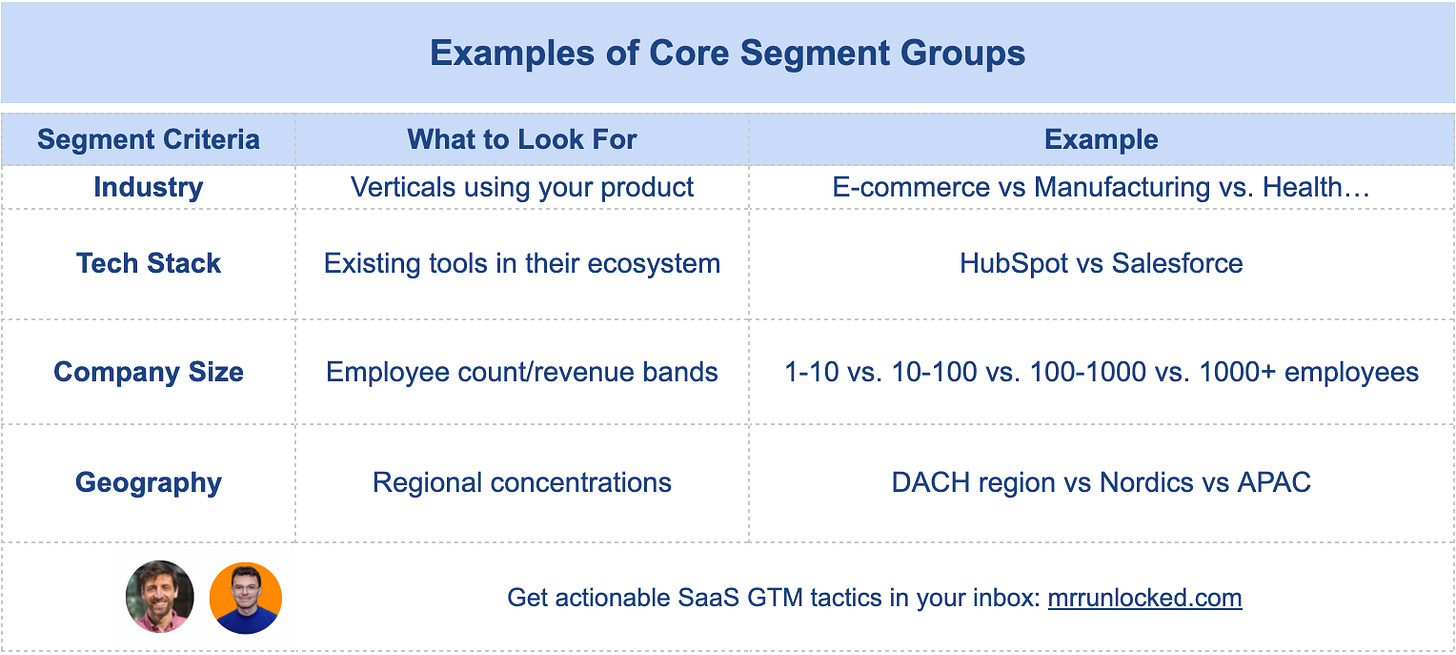

Step 3: First-Pass Segmentation - The "Obvious" Filters

Now you want to create core segment groups based on the criteria you deem are the most important grouping criteria.

Key Insight: These surface-level segments often reveal initial patterns - but rarely the full picture.

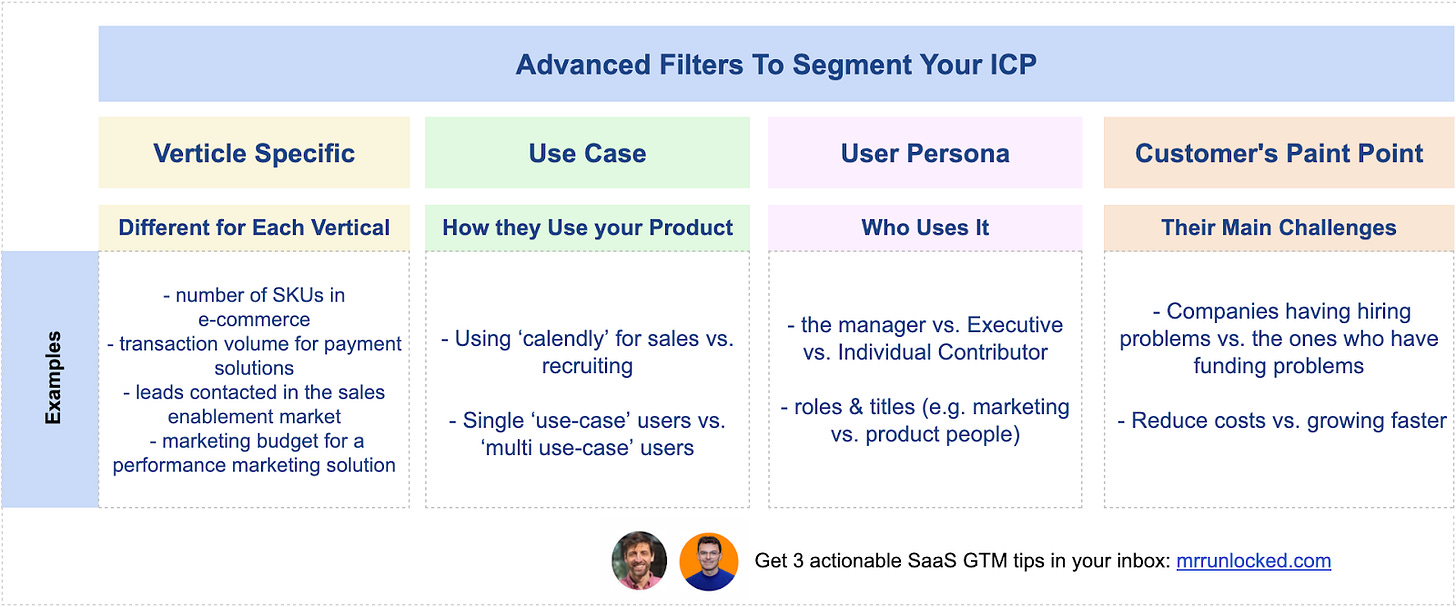

Step 4: Deep-Dive Segmentation - The Hidden Gems

Now you’ll want to go deeper than the above steps. Layer on advanced filters that correlate with value.

Here’s a list of advanced filters (with a few examples) you could apply:

Vertical-specific

number of SKUs in e-commerce

transaction volume for payment solutions

leads contacted in the sales enablement market

the marketing budget for a performance marketing solution

Use case (how they use your product)

Using ‘calendly’ for sales vs. recruiting

Single ‘use-case’ users vs. ‘multi use-case’ users

User persona (who uses your product)

the manager vs an executive vs. Individual contributor?

roles & titles (e.g. marketing vs. product people)

Customers’ main challenges/pain points

companies having hiring problems vs. the ones who have funding problems

Reduce costs vs. growing faster

But in the end, this depends on your business. Every business has different criteria that are relevant to segmenting its market.

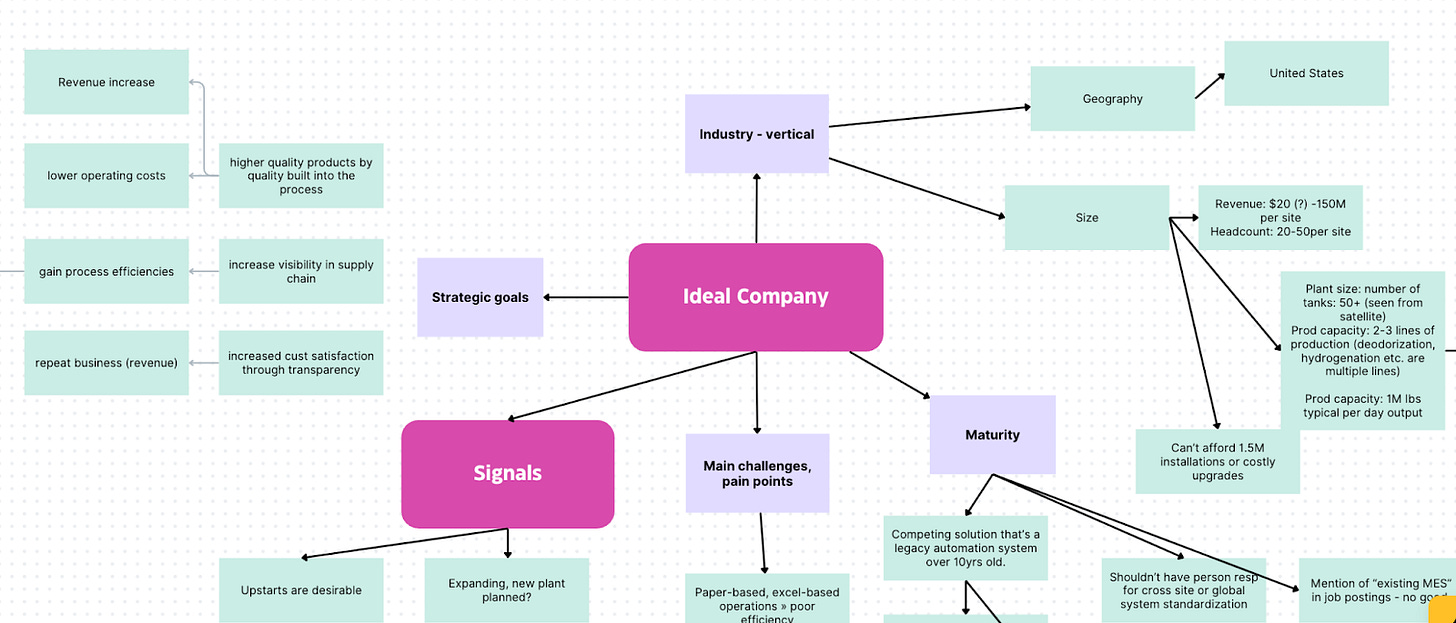

You can mindmap your way to the variables that make a difference like we did, below:

Step 5: Identify Winners: Pattern Recognition Playbook

Now comes the fun part: digging into your data to find the gold nuggets (aka. ideal customers). Segments that consistently outperform on your winning indicators.

Once you’ve done the segmentation in Step 2 and Step 3 and know your winning indicators (step 1), you want to analyze your segments against the ‘best-fit’ customer criteria.

This could look like the following:

(We recommend using Excel or GSheets.)

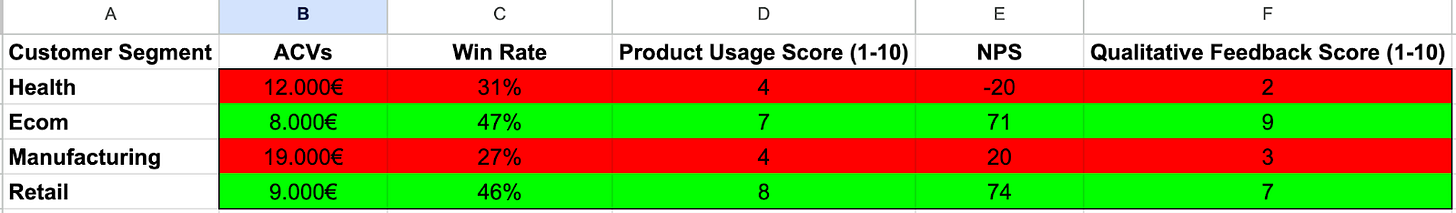

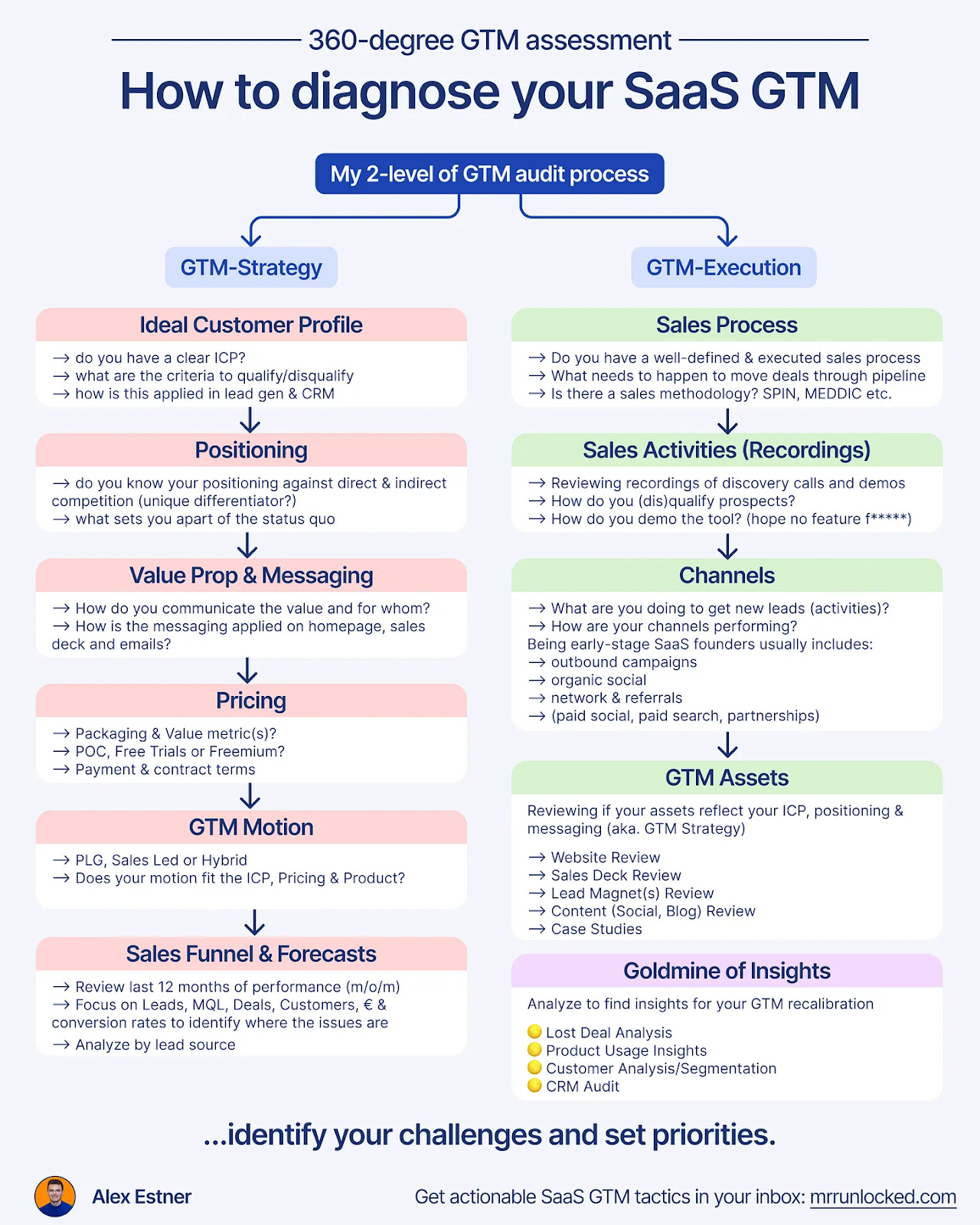

Example: Segmentation based on Industry

Example: Segmentation based on vertical-specific criteria (SKUs in e-commerce)

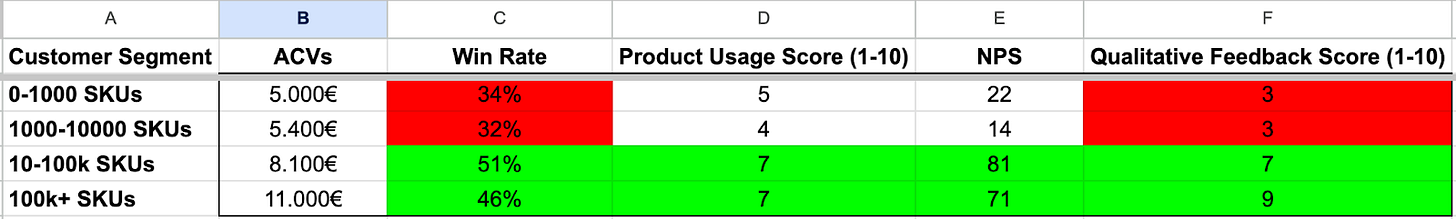

Pro Tip: Create a scoring matrix where each segment gets 1-5 points per category, such as this:

Red Flags

If no segment stands out, either:

✅Wait for more data (if <100 customers) or

✅Re-examine your segmentation criteria

What’s Next Once You Identify Your ICP?

Finding your ICP is just the beginning. The real work starts when you align your entire GTM strategy around this segment.

And trust us, focusing on one segment (your new ICP), means saying NO to a lot of things.

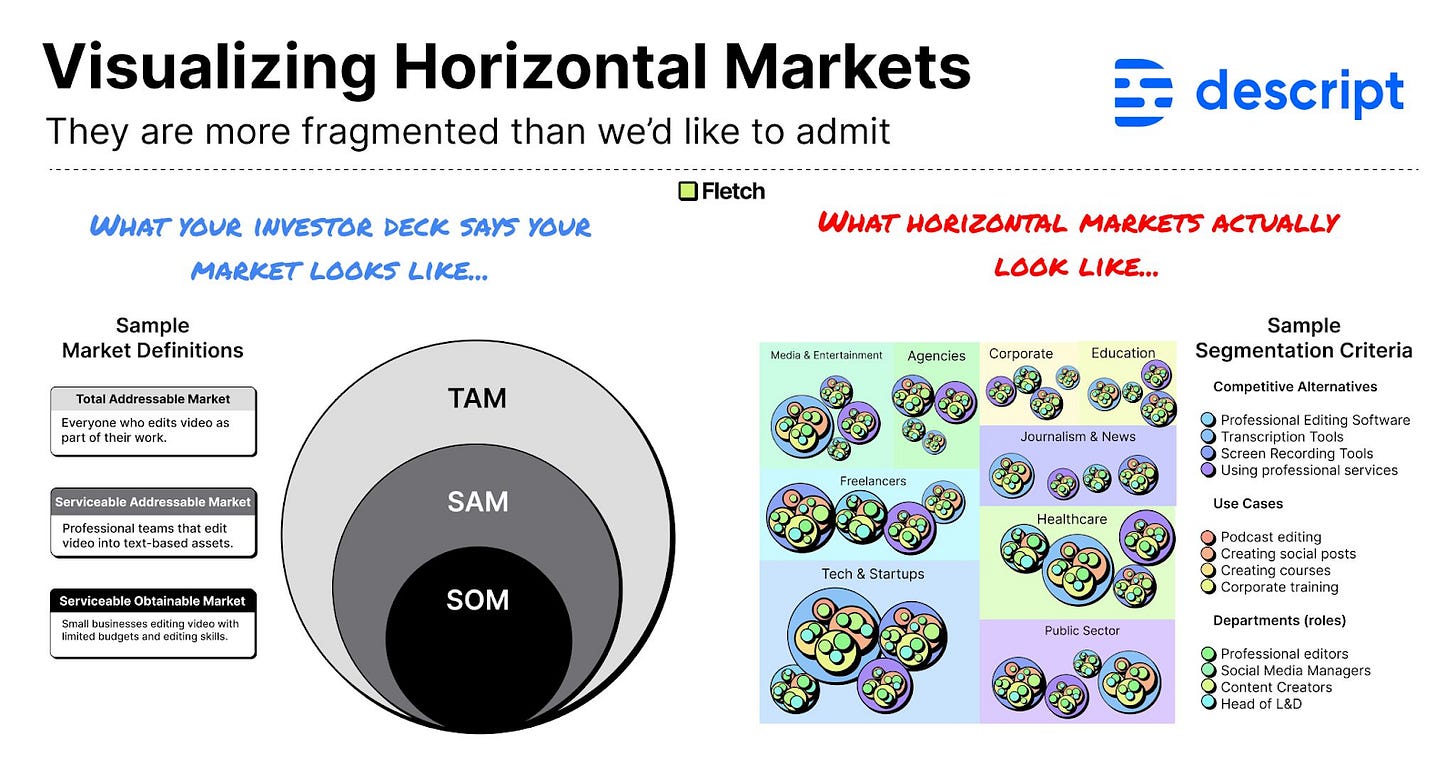

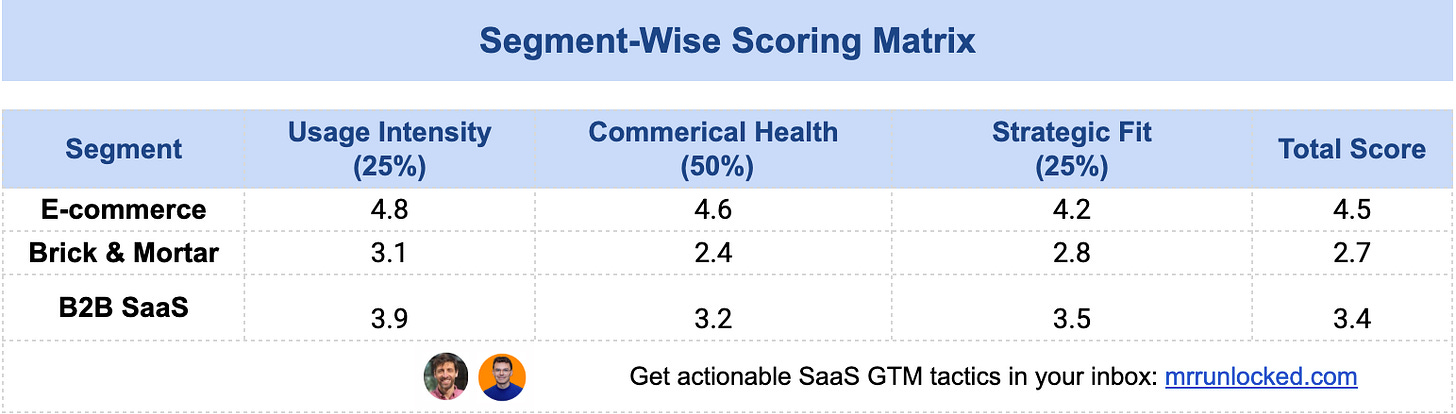

1. Recalibration of your GTM Strategy

Focusing on your ‘new’ ICP means most probably making changes in your GTM strategy.

✅Adapting your positioning?

✅Finetuning your value proposition?

✅Change your messaging?

✅Making changes to your pricing?

2. Revamp Your GTM Assets

This includes things like updating your website copy, sales deck, and LinkedIn profiles.

3. Focus Your Channels & Activities:

Double down on the growth channels where your ICP hangs out.

For instance stronger focus on LinkedIn ads or Google Ads or betting stronger on content or social content on LinkedIn

Remember, you are moving from ‘hustle mode’ to ‘focus mode’ to reach Product-Market Fit as soon as possible.

Case Studies & Examples

This is exactly what I did at Locaboo and Daniel at SalesAutopilot.

Case Study: Locaboo

Challenge

They served clients in different industries and also slightly different use cases. Because of this, the positioning was very broad and GTM efforts were not laser-focused on a clear ICP.

The Process

1. Segmentation by Industry

The company served multiple industries and slightly different use cases. We dig into the data to see that a specific segment outperformed the other segments by far.

2. Further niching down within the industry (by size and use case)

So we drilled down and added additional criteria.

✅amount of resources managed

✅the previously used solution,

✅size of company

✅and the primary use case

3. Identify winning segments

So we analyzed the common characteristics.

We saw that a specific amount of ‘resources managed’ is a leading indicator that the company is a good fit. They showed better metrics, including higher win rates, ACVs, higher product adoption, and almost no churn.

4. Double Down & Revamping GTM

After seeing clear winning segments, it was time to adapt the GTM for this segment. Adapting positioning & messaging. Aligning pricing. Focus on relevant growth channels.

The Result

All relevant GTM metrics increased including increasing win rates from 27% to 50% and increasing ACVs by 60%.

Case Study: SalesAutopilot

Challenge

SalesAutopilot, a marketing automation platform, served SMBs across a bunch of industries; brick-and-mortar, e-commerce, B2B, and info-marketers. The challenge? They were spread too thin and needed to identify their most profitable segment to focus on.

The Process

1. Segmentation by Industry

We chose industries as the segmentation basis because each vertical had distinct use cases. For example, e-commerce brands focused on cart abandonment, while brick-and-mortar businesses used local promotions.

2. Look Beyond Revenue

Revenue alone wasn’t enough. High-revenue segments consumed significant resources—bandwidth, server costs, and customer support hours. With help from the developers, we attributed these costs to each segment and calculated *true profit*.

3. Identify winning segments

E-commerce emerged as the most profitable segment. They engaged deeply with the product, required less support, and were willing to pay for advanced features.

4. Double Down & Revamping GTM

We rebranded and built a promotion around e-commerce, revamped messaging for their pain points, and adjusted pricing tiers. This meant alienating less profitable segments—but it was worth it.

The Result

A 41% increase in monthly recurring revenue (MRR) post-rebrand. To be fair, the results didn’t emerge BECAUSE OF segmentation. Rather, the segmentation paved the way for a kick-ass campaign with messaging and vibe that truly resonated with the most desirable target segment, e-com shops.

Final Thoughts

Validating your ICP isn’t just a marketing exercise. It is a huge, unavoidable part of company strategy.

By focusing on the right customers, you simplify everything: messaging, sales processes, product development, and even customer success efforts. You stop burning resources on bad-fit accounts and start building momentum with a segment that truly values what you offer.

So take the time to analyze your early customers now… it’ll save you years of wasted effort later.

Remember: growth doesn’t come from trying to serve everyone; it comes from serving *someone* better than anyone else can.

Pick your pond, dominate it, and grow from there.

Additional Reads

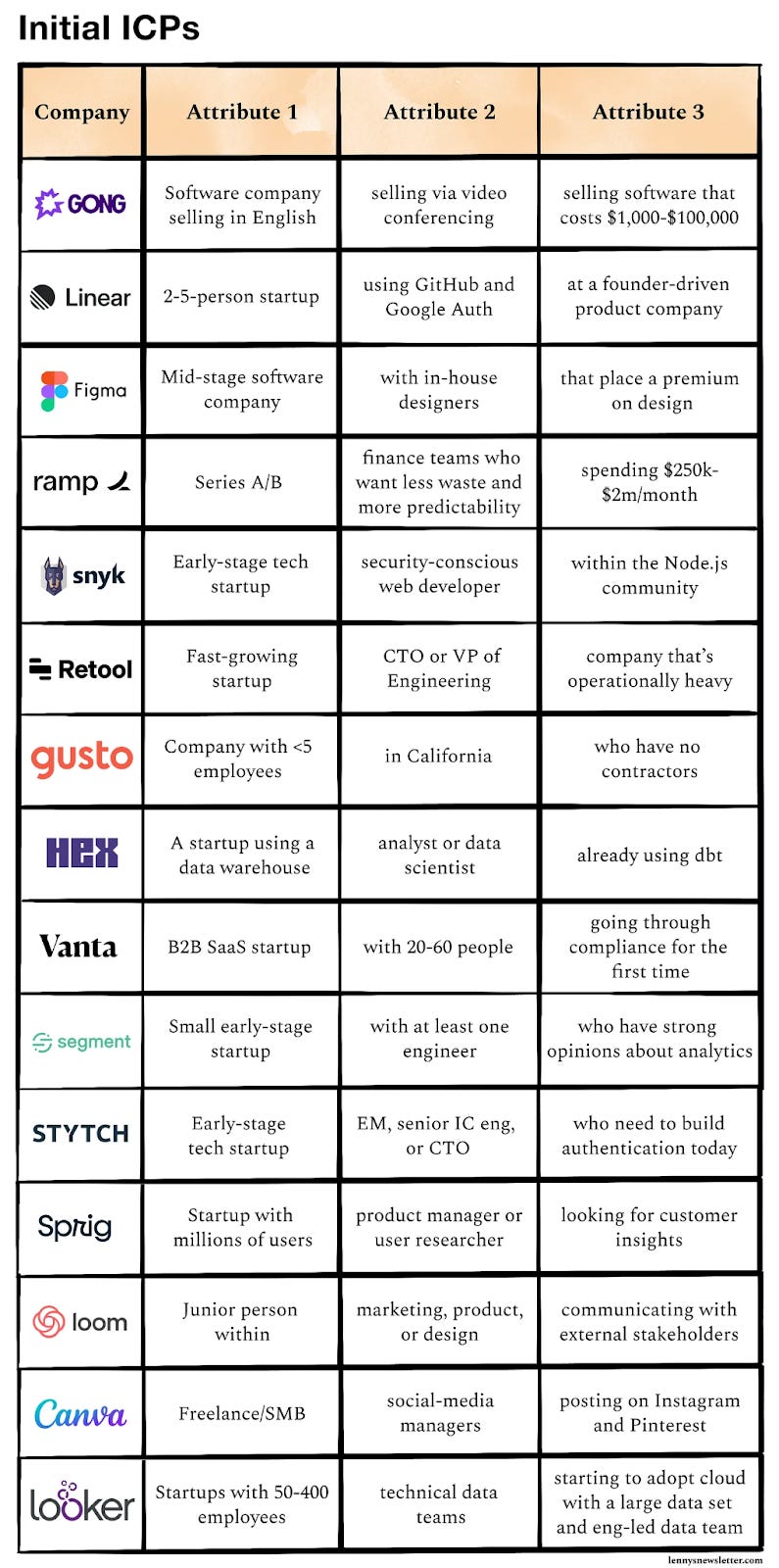

The initial ICPs of top SaaS companies (by Lenny Rachitsky)

Mutiny's ICP Marketing Playbook with Kyle Poyar (Post by Adam Schoenfeld)

Happy growth 🚀

3 ways I can help you grow your SaaS to €1 million ARR 🚀

Build your GTM strategy with my free SaaS GTM Strategy Workbook (helped 4500+ SaaS leaders)

Get access to 100+ actionable SaaS growth tactics (helped 250+ SaaS leaders) - 100% positive ROI guarantee.

Work 1-on-1 with me - GTM Advisory for early-stage SaaS founders on their way to €1 million ARR (1 free spot - limited to 8 founders).

this is SUPER helpful! it feels like a crime to read it for free lol.